How to Apply to Bank of Hawaii Visa Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewWith its fantastic point rewards system and great signup bonuses, the Bank of Hawaii Visa Credit Card can definitely be the perfect choice for you. Should you decide to apply for this card, we are here to provide you step-by-step guidance regarding how to fill in and submit an online application form.

Requirements

Before starting the online application for this card, make sure you meet the requirements listed below:

- Be at least 18 years of age or older

- Be a U.S. citizen or legal resident and have a valid U.S. social security number

- Have a valid U.S. mailing address, a valid phone number and a valid email address

- Be willing to provide information while filling in the application form regarding your current employment status and financial situation

How to Apply

Here is a step-by-step guide on how to fill in and submit an online application for the Bank of Hawaii Visa Credit Card:

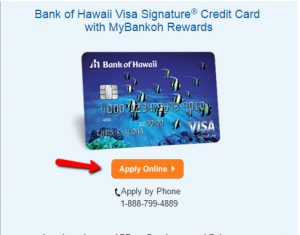

Step 1: Go to the card summary page and click on ‘Apply Online’ for opening the online application form.

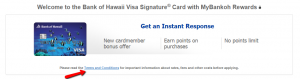

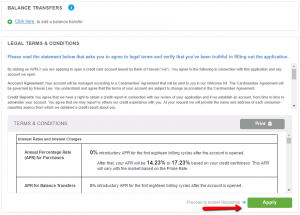

Step 2: Before applying, read carefully the Terms and Conditions associated to your credit card.

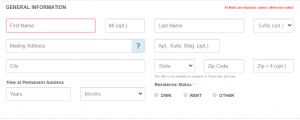

Step 3: Provide some general information about yourself including: first name, middle initial (optional), last name, suffix (optional), mailing address, apartment/suite/building (optional), city, state, Zip code, Zip+4 (optional), time at permanent address (years and months), and residence status (own/rent/other).

Step 4: Enter your employment and financial information including: occupation, total annual income, whether you plan to use this card to get cash at an ATM, and how many times in the last 6 months you have taken a cash advance from any of your credit cards.

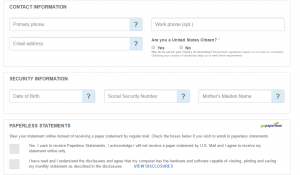

Step 5: Enter your contact information (primary phone, work phone (optional), email address and citizenship), your security information (date of birth, social security number, mother’s maiden name), and choose whether you would like to receive paper or paperless bank statements.

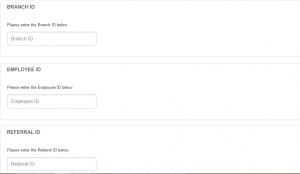

Step 6: Introduce your branch ID, employee ID and referral ID.

Step 7: Choose whether you would like to transfer previous balances to your new account, read once more the legal terms and conditions associated to this credit card and, should you agree with all of them, press the ‘Apply’ button.

FAQs

Q: What does Zip+4 stand for?

The five digit ZIP code is known to everyone, but the existence of Zip+4 is not known and is not frequently used. ZIP+4 Codes are the last 4 digits of a nine-digit ZIP Code since the complete nine-digit ZIP Code consists of two parts. While the first five digits represent the destination post office, the last 4 digits represent a specific delivery route or a smaller delivery zone in that region. Since 1983 when this kind of Zip code was introduced, the greater mail reliability and more successful mail delivery took place.

Q: What is a branch ID?

Branch or transit ID number is the set of numbers on your cheques, which can be found between the cheque number and financial institution number. The first four digits represent your branch number while the fifth one indicates the geographical location of your branch.

Q: What is an employee ID?

The Employer Identification Number or shortly EIN is a unique nine-digit number given by the Internal Revenue Service to business units which are opened and are operating in the United States. The aim of this number is the identification and taxation. Even though the employee ID is similar to a social security number, they cannot replace one another, since employee ID is used for business transactions and activities.

Permium Credit Card Offers

Compare Bank of Hawaii Visa Credit Card

Recently Compared With (by users)

Miles and More Premier World Mastercard

Miles and More Premier World Mastercard

Citi Expedia Credit Card

Citi Expedia Credit Card

Capital One® Spark® Classic for Business Credit Card

Capital One® Spark® Classic for Business Credit Card

KickBack Card

KickBack Card

Abercrombie and Fitch Credit Card

Abercrombie and Fitch Credit Card

Macy’s Credit Card

Macy’s Credit Card

Central Bank ONLY Card MasterCard

Central Bank ONLY Card MasterCard

Diamond Resorts Credit Card

See All Comparisons >>

Diamond Resorts Credit Card

See All Comparisons >>