How to Apply to Capital One Quicksilver Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewIn order to enjoy the convenience and the security of shopping with your Capital One Credit Card, simply follow the application procedures, and once your card is approved, you can experience hassle-free, secure shopping.

Requirements

To start your application to the Capital One Quicksilver card, you need to meet their eligibility requirements:

- You must be at least 18 years of age at the date of application

- Must have a US Social Security Number (SSN)

- Must live in the following locations: the 50 United States, Washington, D.C., or a U.S. military location.

- You must have excellent credit rating

- Have a valid government issued photo ID ( like a driver’s license)

How to Apply

Step 1: Access the Capital one Quicksilver Credit Card through the link, and you will be taken to the homepage.

On the homepage, click on the Apply Now button which should be located directly under the picture of a Quicksilver Credit Card on the upper right side of the page.

Step 2: You will then be redirected to the credit card application page and you will have to provide all information that is asked to complete the application

About Yourself

- First name, middle name, last name

- Street address

- City

- State

- ZIP Code

- Phone number (primary, secondary, employer phone number)

- Social Security Number

- Date of Birth

- Total annual income

- Home ownership status (own, rent, other)

- Monthly rent/ mortgage

- Approximate monthly credit card spending

- If you are interested in transferring your balance (Yes or No)

- How often you carry a balance on your credit cards

- Number of authorized users to add on your account

Step 3: Provide additional information such as

- Employment status

- Employer name (If applicable)

- Would you be interested in availing of checks (yes or no)

- Specify your bank accounts (savings, checking or both)

- Total value of bank accounts

- Total value of investments

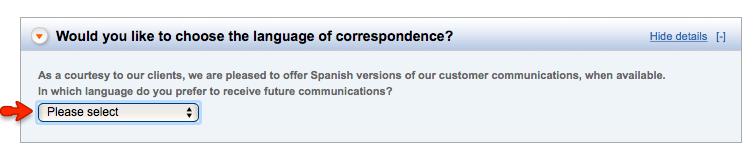

Step 4: You have the option to choose your language of correspondence, either English or Spanish using the drop down menu.

Step 5: Before completing your application, make sure to take the time to read and understand the terms and conditions, if you agree, click Continue to Review and follow the prompts.

FAQs

Q: What is a grace period?

A grace period is an interest free period given to the cardholders in case they did not manage to fulfill their obligation on time and it represents the period immediately after the deadline. The grace period length differs from 3 days to up to 30 days. Actually, the limited payment time is waived provided that the obligation is satisfied during that grace period.

Q: Can my Capital One Quicksilver Credit Card be used for Spotify Premium subscription and what does it include?

Yes, you can use your QuicksilverOne card for Spotify Premium subscription and you will get 50% back as a statement credit on your monthly purchase.

Q: What does a credit report show?

A credit report is used by the credit card issuers to show your credit history so as to be able to determine whether you are eligible for the card or not, an each credit report includes the data about how often you make payments on time, how much credit you have available and how much credit you are using. It is issued by the credit bureaus which compile credit reports from lenders, such as banks, creditors, department stores and create a credit reports according to the information that are sent to them.

Permium Credit Card Offers

Compare Capital One® Quicksilver® Cash Rewards Credit Card

Recently Compared With (by users)

Discover it Chrome Student Credit Card

Discover it Chrome Student Credit Card

UMB Visa Credit Card

UMB Visa Credit Card

USAA Rewards Visa Signature Card

USAA Rewards Visa Signature Card

L.L. Bean Credit Card

L.L. Bean Credit Card

Nordstrom Credit Card

Nordstrom Credit Card

Best Western Rewards MasterCard

Best Western Rewards MasterCard

Maurices Credit Card

Maurices Credit Card

BBVA Compass Select Credit Card

See All Comparisons >>

BBVA Compass Select Credit Card

See All Comparisons >>