How to Apply to Capital One Secured Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewWith its generous signup bonus and different types of travel insurance its holders can benefit from, the Capital One Secured Credit Card is a very good option. On this page, we will provide a step-by-step guide on how to complete an online application for getting this card.

Requirements

In order to be eligible to apply for this card you must meet the following requirements:

- You should have a valid U.S. mailing address, email address, and phone number

- You should not be currently in a correctional institution

- Your monthly income should exceed your rent/mortgage rate

- You should be at least 18 years of age

- You should have a valid Social Security Number or Taxpayer ID Number

- In case you have 2 or more Capital One account, a past due Capital One account, or non-discharged bankruptcies you are NOT eligible to apply

How to Apply

Here are the steps you need to take in order to access and fill in the online application form for getting a Capital One Credit Card:

Step 1: Go to the card’s main page and click on the ‘Apply Now’ button in order to open the page containing the online application form.

Step 2: Read carefully the information about the card provided on the top of the application form including the Rates & Disclosures.

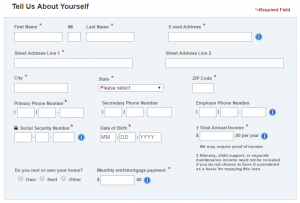

Step 3: Introduce in the appropriate fields details about yourself including your first and last name, email address, mailing address (city, state, ZIP code), primary phone number (and optionally, secondary phone number and work phone number), social security number, date of birth, total annual income and monthly rent or mortgage rates.

Step 4: Add additional information such as your current employment status, whether you would be interested in getting blank checks for cash advances or not, and details about your other bank accounts.

Furthermore, you also have the chance to choose your favorite language of correspondence. Finally, after carefully reviewing the application terms, click on the ‘CONTINUE TO REVIEW’ button.

FAQs

Q: I am applying for the Capital One Secured credit card, but I do not know what to include when calculating my income.

When calculating you income, the following things should be included. Personal Income represents your full-time, part-time or seasonal jobs income, as well as self-employment, interest or dividends and retirement income. Your shared income is the money that you get from somebody else but is deposited into your individual account regularly. There is also an optional Income which might not be included such as alimony and child support. It depends on you whether you want to include the optional income or not.

Q: Can I use my Capital One Secured credit card out of my country?

The Capital One Secured credit card is a Visa card and can be used wherever Visa is accepted. The usage outside of the country is available and Capital One does not charge a fee when you use your credit card for foreign currency transactions. You do not even need to contact Capital One before using it out of the country. Considering the fact that Capital One cards use EMV chip technology, secure transactions abroad are available to every cardholder. There is a phone number in case you have an issue regarding the card which you may contact when you are out of the U.S. and that is an international telephone number 1-800-955-7070.

Permium Credit Card Offers

Compare Capital One® Secured Mastercard® Credit Card

Recently Compared With (by users)

Barclaycard Rewards Mastercard

Barclaycard Rewards Mastercard

Bealls Florida Credit Card

Bealls Florida Credit Card

AAA Member Rewards Credit Card

AAA Member Rewards Credit Card

Pier One Credit Card

Pier One Credit Card

Sears Credit Card

Sears Credit Card

ABNB Visa Platinum Rewards Credit Card

ABNB Visa Platinum Rewards Credit Card

BrandsMart USA Credit Card

BrandsMart USA Credit Card

Wells Fargo Visa Signature Card

See All Comparisons >>

Wells Fargo Visa Signature Card

See All Comparisons >>