How to Apply to Capital One Spark Business Classic Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

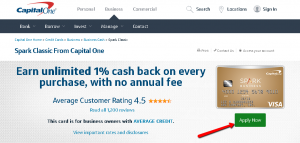

Click here to leave a reviewThe Capital One Spark Classic Business Credit Card offers 1% cash back for every purchase you make and you have to pay no annual fees. If you want to acquire this card, you can now order it online and save your time of paying a visit to the store nearby. Here we’ll guide you through the online application process.

Requirements

To be eligible for this card you must:

- Be the owner, partner, president, vice-president or corporate secretary of a business company

- Possess a Business Tax ID Number(TIN) or Employer ID Number(EIN)

- Have a residence in the U.S. as well as a valid phone number and email address

- Have a valid Social Security Number or a Taxpayer ID Number

How to Apply

Applying for the Capital One Spark Classic Business Credit Card is quite easy. If you have any concerns about this, we recommend to follow our step-by-step guide below:

Step 1: First, visit the card’s homepage and click on the ‘Apply Now’ button. This will redirect you to the online application form.

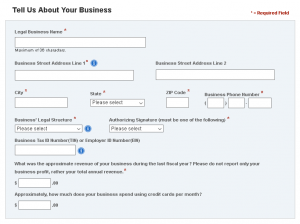

Step 2: In the online application page, introduce the mandatory information regarding your business such as your Business Legal Name, business address (street, city, state, Zip code) and business phone number.

Select your specific business’ legal structure among sole proprietorship, corporation, partnership, non-profit corporation, limited liability company or other, as well as the authorizing signature, by choosing one of the following: owner, partner, president, vice-president, corporate secretary or other. Introduce the Business Tax ID Number(TIN) or Employer ID Number(EIN) and provide the business’ total annual revenue amount.

At the end of this section, indicate the approximate monthly amount needed by your business for credit card operations.

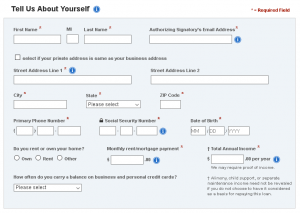

Step 3: In the personal information section, make sure to include: you first name, middle initial (optional), last name, the authorizing signatory’s email address, home/permanent address, city, state, Zip code, primary phone number, social security number, date of birth, housing status, monthly mortgage or rent payment and total annual income.

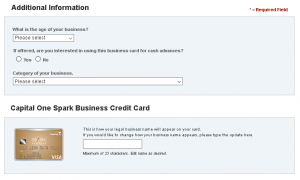

Step 4: In the additional information section, select the age and category of your business.

In this section, you can also choose the legal business name which will appear on your card.

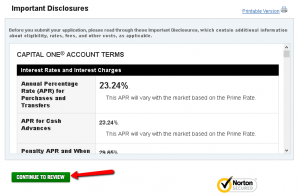

Step 5: Pay attention to the important disclosures including the terms and conditions associated with this card.

After reading the card’s terms and conditions, simply click on the ‘Continue to review’ button.

Your application will be forwarded to the bank and soon you’ll be notified about the result of your online application.

FAQs

Q: What does an automatic redemption preference stand for?

An automatic redemption preference is the option offered to Capital One Spark Business Classic credit card holders where they can set up to redeem their points automatically, at certain period of time and receive a cash back. The system will always redeem the points at the assigned date. The automatic redemption preference date can be changed at any time. There is also a possibility of making upon-request redemptions without changing your pre-established automatic redemption preference. If the automatic redemption preference is not set up or you decide to turn it off, your points will be redeemed upon your request.

Q: What kind of business owners are not eligible for Capital One Spark Business Classic credit card?

The Business owners that are not eligible for Capital One Spark Business Classic credit card are those who have applied for a Capital One credit card 2 or more times in the last 30 days or have 5 or more open credit card accounts with Capital One.

Q: Are there any tricks to avoid paying interest charges?

You do not need any tricks so as to avoid paying interest charges, since as long as you pay your statement’s balance in full by the due date, you will not be charged interest on any new transactions that post to the Purchase balance. The Capital One sometimes offers its clients the possibility of paying less than the total balance and avoiding interest charges to new transactions.

Permium Credit Card Offers

Compare Capital One® Spark® Classic for Business Credit Card

Recently Compared With (by users)

Shell Platinum Credit Card

Shell Platinum Credit Card

Chase Amazon Credit Card

Chase Amazon Credit Card

The Blue Business® Plus Credit Card from American Express

The Blue Business® Plus Credit Card from American Express

Amex Everyday Preferred Credit Card

Amex Everyday Preferred Credit Card

State Farm Student Visa Credit Card

State Farm Student Visa Credit Card

Scheels Visa Credit Card

Scheels Visa Credit Card

Southwest Rapid Rewards Premier Credit Card

Southwest Rapid Rewards Premier Credit Card

Bank of America® Cash Rewards Credit Card

See All Comparisons >>

Bank of America® Cash Rewards Credit Card

See All Comparisons >>