How to Apply to Capital One® VentureOne® Rewards Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewThe Capital One® VentureOne® Rewards Credit Card may be the best option if you are into traveling and looking for discounts on your airline tickets and hotels. Now you can apply for this card online and do not need to lose your time for paying a visit at a store nearby. Follow our guide below to learn more about the online application process.

Requirements

To be eligible for this card you must:

- Be at least 18 years of age

- Have a residence in the U.S. as well as a valid phone number and email address

- Have a valid Social Security Number or a Taxpayer ID Number

How to Apply

If you have any concerns about the online application for your new VentureOne Card, we recommend to follow our step-by-step guide below:

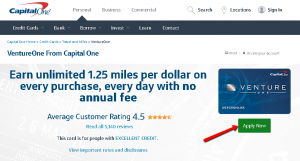

Step 1: Navigate to the Capital One VentureOne Credit Card’s homepage and click on the ‘Apply Now’ button as you can see in the picture below.

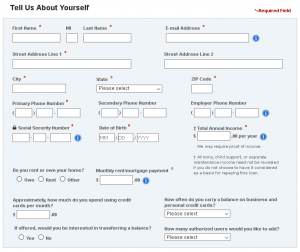

Step 2: Scroll down the page until you reach the personal information section.

Here you must provide the following information: your first name, middle initial (optional), last name, email address, home/permanent address, city, state, Zip code, primary phone number, social security number, date of birth, housing status (own/rent/other), monthly mortgage or rent payment and total annual income.

Provide an answer to the questions regarding your card’s usage such as the approximate monthly amount you spend for credit card operations and the frequency of balance transfers on business and personal credit cards, as well as provide information on your likeliness to make any balance transfer or add other users.

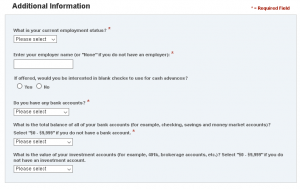

Step 3: In the additional information section, indicate your employment status, your employer’s name, your interest in blank checks to use for cash advances.

Finally, provide information about additional bank accounts owned by you.

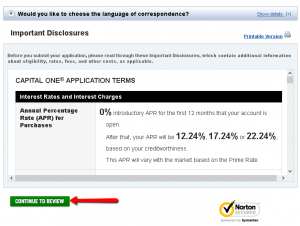

Step 4: Read and agree with the important disclosures including the terms and conditions associated with this card.

Afterwards, simply click on the ‘Continue to review’ button. Your online application is finally completed and the bank will contact you about the results of your application.

FAQs

Q: Can my account terms ever be changed?

Yes, there are some situations when the card issuer is forced to change the terms of your account, and that is permitted and determined by law. In case that situation happens, the card issuer is obliged to inform you about the terms changes by sending you a notice before changing them.

Q: What does emergency card replacement stand for?

In numerous occasions credit card happen to be lost or stolen, and that represents the worst nightmare to cardholders. However, the credit card issuers are doing their best to increase the level of protection in case this situation happens. Also, there are people who need their credit card as soon as possible, and they can get an emergency card replacement and a cash advance. They just need to ask for emergency card replacement in any of the nearest issuer’s branches.

Q: What is a blank check?

A blank check is a check that has been signed by the check owner, but the numerical value and other information, such as date and payee has not been written in, but is already signed. The blank check can be filled in by anyone and therefore it can be a subject to abuse. A blank check can be extremely dangerous for its owner since any amount of money written on it could be raised.

Permium Credit Card Offers

Compare Capital One® VentureOne® Rewards Credit Card

Recently Compared With (by users)

Target Red Card Credit Card

Target Red Card Credit Card

First Savings Credit Card

First Savings Credit Card

The Platinum Card® from American Express

The Platinum Card® from American Express

Apple Rewards Credit Card

Apple Rewards Credit Card

American Kennel Club Visa Credit Card

American Kennel Club Visa Credit Card

AgFed Credit Union Classic Visa Credit Card

AgFed Credit Union Classic Visa Credit Card

Milestone Gold MasterCard Credit Card

Milestone Gold MasterCard Credit Card

Macy’s Credit Card

See All Comparisons >>

Macy’s Credit Card

See All Comparisons >>