How to Apply to CFCU Visa Classic Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewThe CFCU Classic Visa Credit Card, issued by the CFCU Community Credit Union offers basic advantages for classic users, which means it doesn’t include any rewards or signup bonuses. Should you decide to apply for this card, below you can find a step-by-step guide regarding how to fill in and submit an online application form.

Requirements

Before starting the online application for this card, make sure you meet the requirements listed below:

- Your annual income must be at least $5,000

- Be a U.S. citizen or a permanent resident alien

- Be at least 21 years of age or provide a guarantor, or demonstrate independent means to repay debt.

- Applicants must be CFCU members

How to Apply

Here is a simple guide on how to fill in and submit an online application for the CFCU Visa Classic Credit Card:

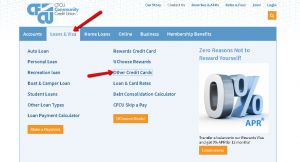

Step 1: Visit the CFCU homepage and click the ‘Other Credit Cards’ link under the ‘Loans & Visas’ menu.

Step 2: In the new window press the ‘Apply today for any of our credit card offerings’ button.

Step 3: If you do not have already a membership at the CFCU you need to enroll as a non-member before starting your application. Notice that this step is mandatory for the online application. For the non-member enrollment application, you simply need to introduce your first and last name, your SSN as well as choose a password and click Enroll.

Step 4: In the Loan Application window which will open, select the Visa Application and your preferred insurance type and click the ‘Apply’ button.

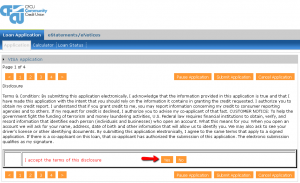

Step 5: Read carefully and accept the Disclosure Terms by clicking ‘Yes’ in order to proceed.

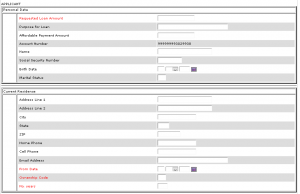

Step 6: In the application window introduce the required information including the amount of loan, purpose of loan request, affordable payment amount, your account number, your full name, your social security number, date of birth and marital status. Make sure to enter your housing and contact information including your mailing address, city, state, Zip code, home phone number, cell phone number, email address, time at permanent address, ownership code and years at the current address.

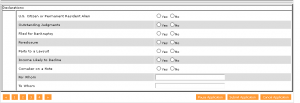

Step 7: Answer by ticking Yes or No to the declaration questions related to your U.S. residence status, outstanding judgment, filed bankruptcy, foreclosure, lawsuit party, income likely to decline, and select comaker on a note. To continue press ‘Submit Application.’

FAQs

Q: What is an auto deduct option?

Auto deduct option is the same as automatic payments and it allows you to pay bills on a specific day of the month without forgetting it, since late fees and interest charges that the missed payments is followed with can hurt your credit score. You just need to set up payments with your bank, choose the payee and the amount you want to pay and the date you want the money sent and it will be deducted from your account.

Q: If I perform a balance transfer using my CFCU Visa Classic Credit Card will I earn any points?

Unfortunately, balance transfers do not earn you points, only the purchases might increase your point’s level. Nevertheless, CFCU offers it clients the option of performing a balance transfer with their Convenience Checks which will reward you with points.

Q: I want to redeem points that I have gained by using my CFCU Visa Classic Credit Card, but I want them to be sent to address other than the one stated in my application. Is that possible?

Yes, you can have the items sent to another address located in the U.S., since CFCU allows the clients to change the address for their redemptions.

Permium Credit Card Offers

Compare CFCU Visa Classic Credit Card

Recently Compared With (by users)

Huntington Credit Card

Huntington Credit Card

Chevron VISA Card

Chevron VISA Card

Kohl’s Credit Card

Kohl’s Credit Card

USAA Rewards Visa Signature Card

USAA Rewards Visa Signature Card

Wyndham Rewards Visa Credit Card

Wyndham Rewards Visa Credit Card

American Express Plum Card Credit Card

American Express Plum Card Credit Card

Mercedes-Benz Amex Credit Card

Mercedes-Benz Amex Credit Card

Carnival Cruises Credit Card

See All Comparisons >>

Carnival Cruises Credit Card

See All Comparisons >>