How to Apply to Chase Sapphire Preferred Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewWith its fantastic point rewards system and generous bonuses, the Chase Sapphire Preferred Credit Card is a great option for a large variety of customers. If you decide to get this card, we are here to guide you through the process of completing and submitting an online application for this card.

Requirements

In order to be able to successfully complete your application, you must ensure that you meet the following requirements:

- You must be at least 18 years old

- You should be a permanent legal resident of the United States of America

- You should have a valid social security number, a valid postal address, a valid email address, and a valid phone number

- You have to be willing to provide information about your financial and employment status (such as your employer and your gross annual income)

How to Apply

Here are the steps you need to follow in order to fill in an online application form for this card:

Step 1: Open the credit card’s homepage and click on the ‘Apply Now’ button to access the secure online application form.

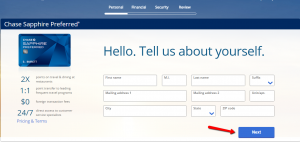

Step 2: Provide your personal information. Make sure to include your first and last name, mailing address, city, state and Zip Code and, optionally, your middle initial, suffix and unit/apartment. Click ‘Next’ to continue.

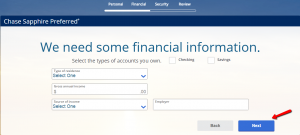

Step 3: Introduce your financial information, including your type of residence, gross annual income, source of income and employer and press ‘Next.’

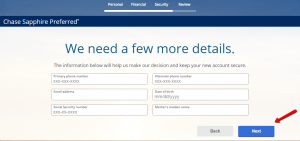

Step 4: Provide some security details such as your primary phone number (and optionally an alternate phone number), your email address, your date of birth, your social security number and your mother’s maiden name.

After you click one more time on the ‘Next’ button you will be asked to review carefully all the information you introduced and finally submit your online application.

FAQs

Q: I am trying to find a trick to raise my credit score quickly.

The first thing you can do is to pay off your credit card bills before the statement prints. When the statement is printed, the amount owed can hurt your score. Also, be aware that 10% of your score is made up by the types of credit you have used, so it can be good to have cards from multiple banks. And, the last thing is to use business cards, since amounts owed on business cards are not reported on your personal credit report and it will not hurt your score.

Q: Whichever card I try to apply to, they always decline me. How can I improve my credit score in order to get a card?

You can try by having someone add you as an additional user onto their account for some time, which will get a nice boost on your credit score from that. You can also apply for some store cards because it is easier to get approved for them. Another option is to get a secured card which is designed so as to help the cardholders build their credit score. There are some banks which offer a student card which is also easier to get than regular credit cards, so you can try with it, too.

Permium Credit Card Offers

Compare Chase Sapphire Preferred Card

Recently Compared With (by users)

Farm Sanctuary Credit Card

Farm Sanctuary Credit Card

Ashley Furniture Credit Card

Ashley Furniture Credit Card

Victoria’s Secret Angel Credit Card

Victoria’s Secret Angel Credit Card

Alaska Airlines Visa Credit Card

Alaska Airlines Visa Credit Card

Citi® / AAdvantage® Executive World Elite™ Mastercard® Credit Card

Citi® / AAdvantage® Executive World Elite™ Mastercard® Credit Card

Virgin Atlantic MasterCard Credit Card

Virgin Atlantic MasterCard Credit Card

American Express Blue Card

American Express Blue Card

ASU Platinum Credit Card

See All Comparisons >>

ASU Platinum Credit Card

See All Comparisons >>