How to Apply to Citi Double Cash Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewThinking about applying for the Citi Double Cash Credit Card? Applying for this card, you will be rewarded with cash back twice with %1 on purchases and %1 when you pay for your purchases. The second thing that makes it a nice card is a very long introduction period. You’ll get 0% APR on balance transfers for 18 months! After that, your APR may vary depending on your creditworthiness.

Requirements

If you are going to apply for Citi Double Cash Back Credit Card, make sure you meet those requirements:

- Must be at least 18 years old;

- Must have a valid ID;

- Must provide mailing (postal) address;

- Good credit score.

How to Apply

Step 1 – To begin with, go to the Citi Bank website. Then press ‘Apply Now’ button.

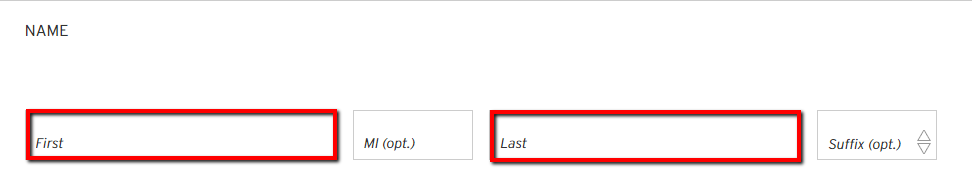

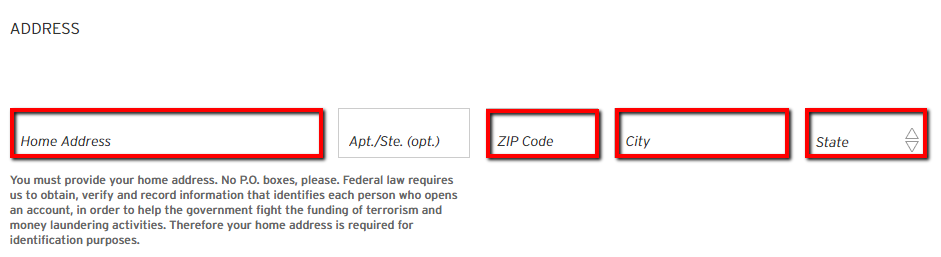

Step 2 – On the first step of your application, you will be asked to provide your Name and Address. So enter your First and Last Name (write down your Middle Name or Suffix, if you have one). Then enter your Home Address ( if you want, you can add your Apartment, but it is optional), your Zip Code, City, and State.

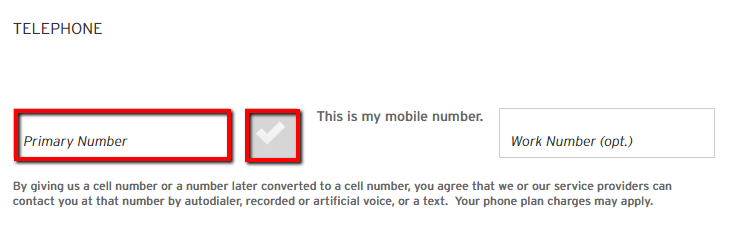

Step 3 – Now enter your Primary Number and confirm, that it is really your mobile number.

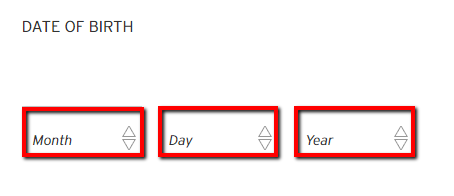

You can add your Work Number, but it is not required. After that add your Date of Birth in format Month/Day/Year.

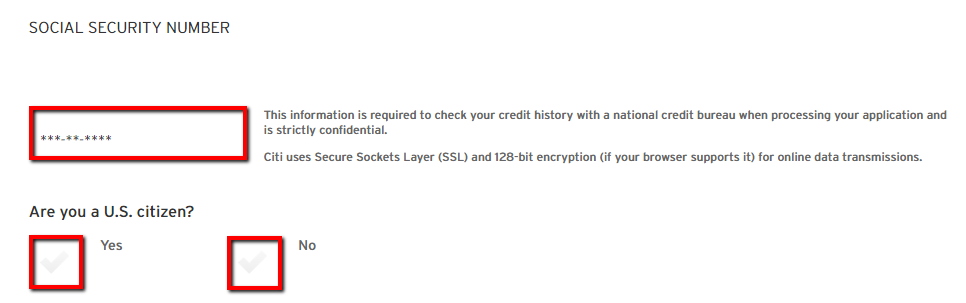

Step 4 – Enter your Social Security Number and choose, if you are US citizen or not.

It is required to check your credit history with a national credit bureau.

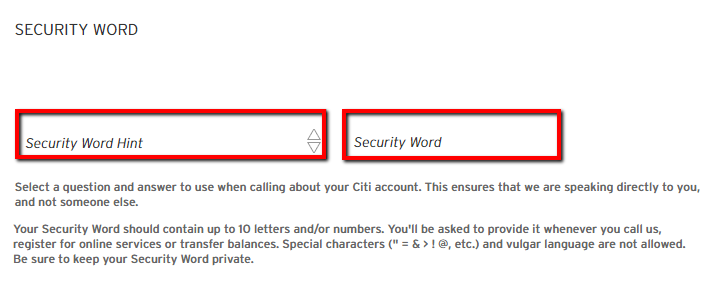

Step 5 – Choose security question from the list and write down an answer. Don’t forget the answer, because you may need this in future.

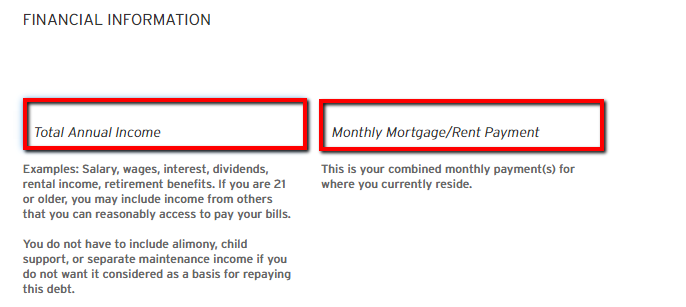

Step 6 – Provide your Financial Information. You have to enter your Annual Income and your Monthly Mortgage/Rent Payment.

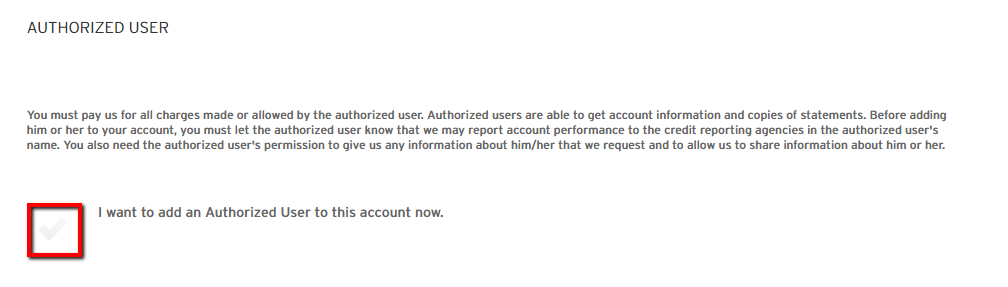

Step 7 – Now you can add an authorized buyer to your account.

If you want to add one, press ‘I want to add an Authorized User to this account now’. If you don’t want – just skip this step.

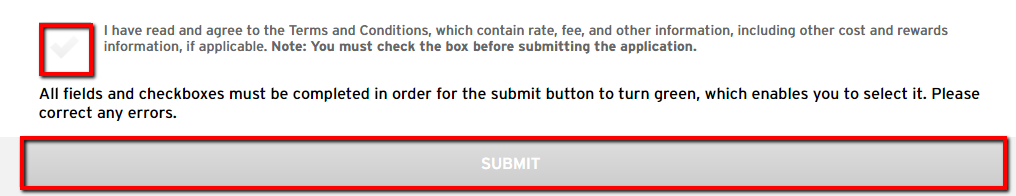

Step 8 – You are almost there. Confirm that you’ve read Terms and Conditions and press ‘Submit’.

FAQs

Q: What does credit card late fee pass stand for?

With Citi Double Cash credit card you get a pass on your first late fee. Actually, when you miss the due date minimum payment for the first time, you get Credit card late fee pass, which adds up to more peace of mind by allowing you to pay your debt without any penalties.

Q: What happens with my earned rewards if I decide to close my Citi Double Cash Credit Card account?

The account closure is followed by certain consequences which include that you will no longer be able to earn or redeem your cash rewards, and you will forfeit all collected cash rewards so far. So, it is advisable to redeem any eligible cash rewards before your account closure in order not to lose them.

Q: What are other benefits to using this card to make purchases besides earning rewards points?

There are quite a few benefits to using Citi Double Cash Credit Card besides double points. Purchases you charge to this card belong to extended warranties purchases, meaning that the warranty period for the bought items is prolonged. You also benefit from damage and theft purchase protection. Actually, items bought with your Citi card which are damaged or stolen within 120 days after being purchased can get you a refund. Another advantage is the Citi Price Rewind service, so if you find lower prices for the items you purchased with your Citi Double Cash Credit Card during 60 days after the purchase, you may be reimbursed for the difference.

Permium Credit Card Offers

Compare Citi Double Cash Credit Card

Recently Compared With (by users)

Gander Mountain Credit Card

Gander Mountain Credit Card

AARP Credit Card

AARP Credit Card

Princess Cruises Rewards Visa Credit Card

Princess Cruises Rewards Visa Credit Card

Abercrombie and Fitch Credit Card

Abercrombie and Fitch Credit Card

Lowe’s Consumer Credit Card

Lowe’s Consumer Credit Card

Affinity Credit Union Choice Rewards World Elite Mastercard

Affinity Credit Union Choice Rewards World Elite Mastercard

Chevron Premium Credit Card

Chevron Premium Credit Card

Chrysler MasterCard

See All Comparisons >>

Chrysler MasterCard

See All Comparisons >>