How to Apply to Credit One Cash Back Rewards Visa Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewWith its great cash back rewards and other benefits such as travel accident insurance and auto rental collision damage waiver, the Credit One Cash Back Rewards is a perfect card to have. On this page, we will show you the procedure you must follow in order to get one.

Requirements

In order to be able to complete the application process successfully, you must make sure you meet the following requirements / eligibility criteria:

- You should be 18 years of age or older

- You must be a permanent legal resident of the United States of America

- You must ave a valid Social Security number

- You must have a valid postal address, Email address and phone number

- You should be currently employed and provide details about your currently monthly income during the application process

- You should NOT have another open account with the same bank

How to Apply

In order to be able to apply for this card, you must first prove that you are pre-qualified. After showing this, your application will be assessed and you will soon receive information from the bank regarding how you should proceed further. In order to get pre-qualified, here are the steps you should take:

Step 1: Go to the credit card’s login page and click on the ‘Get Pre-Qualified’ button. This will lead you to another page where you must provide information about yourself.

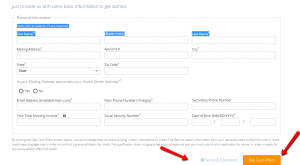

Step 2: Fill in all the required fields, including information about yourself such as your first name, last name, mailing address (street, city, state, Zip code), email address, main phone number, secondary phone number (optional), total monthly income, social security number and date of birth.

After this, read carefully the terms and conditions and press on the ‘See Card Offers’ button in order to get pre-qualified and see which card would fit you best.

Afterwards, you will be soon notified whether you qualify in order to apply and will be given more information on how to complete the application process.

FAQs

Q: What does an optional Credit Protection include?

Optional Credit Protection is a debt cancellation program which is offered by Credit One Bank to the owners of their credit card accounts. In case of unemployment or disability, the Credit Protection Program cancels benefit payments for the primary cardholder and even cancels the full balance in the event of death. If you want to apply for Credit Protection Program benefits after you have obtained your credit card, you should call 1-866-803-1745 or you can go to the 'Customer Service' page of our website and apply for it.

Q: What is an auto rental collision damage waiver?

Auto rental collision damage waiver is optional damage insurance coverage which you can get when you rent a car, since rental companies treat it a waiver of their right to make the renter pay for damages to the rented car. Actually, collision damage waiver is a protection which limits how much a car hire company can claim from the renter if certain parts of the rental car were damaged while he/she had it.

Q: What is not covered by collision damage waiver?

What is and what is not covered by collision damage waiver depends on each car hire company, because they have own version, but what is usually covered is the bodywork of the car and the engine. However, the collision damage waiver does not cover windows and mirrors, wheels and tires, interior of the car, flat battery, lost keys, additional equipment, like GPS, child seats and towing charges.

Permium Credit Card Offers

Compare Credit One Cash Back Rewards Visa Credit Card

Recently Compared With (by users)

Chevron Credit Card

Chevron Credit Card

Club Carlson Business Rewards Visa

Club Carlson Business Rewards Visa

Chase Amazon Credit Card

Chase Amazon Credit Card

Kohl’s Credit Card

Kohl’s Credit Card

Priceline Rewards Credit Card

Priceline Rewards Credit Card

PNC Core Visa Credit Card

PNC Core Visa Credit Card

J Crew Credit Card

J Crew Credit Card

Citi ThankYou Credit Card

See All Comparisons >>

Citi ThankYou Credit Card

See All Comparisons >>