Fifth Third Platinum MasterCard Login | Make a Payment

Card Info

Card Info

Application

Application

Card Rating

Share Your Opinion

Review this card now and let others know your thoughts.

Click here to leave a reviewThe Fifth Third Platinum MasterCard offers you not only fantastic cash back rewards and signup bonuses but also the possibility to easily manage your account online. On this page, we will show you how to log in, retrieve your credentials and set up an online account.

How to Login / Make a Payment

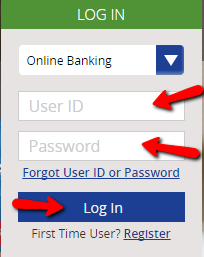

In case you already have access to online banking, here is what you have to do in order to sign in to your account:

Step 1: Open the credit card’s main webpage and click on the ‘LOG IN’ button in order to open a pop-up window where you can introduce your credentials.

Step 2: Introduce your User ID and Password and press ‘Log in.’

Forgot Password / Username

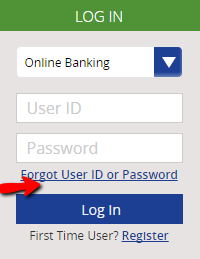

If you forgot your password, these are the steps you need to follow in order to retrieve it:

Step 1: Go to the credit card’s main webpage and click on ‘LOG IN’ button in order to open the login pop-up window.

Step 2: Click on the ‘Forgot User ID or Password’ button.

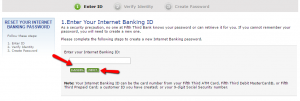

Step 3: Enter your internet banking ID and press ‘NEXT.’

Step 4: In the next pages you will be able to verify your identity and create a new password.

Activation / Registration

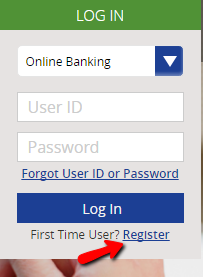

In case you don’t have yet an online account associated with your credit card, here are the steps you should follow in order to set up one:

Step 1: Navigate to the credit card’s homepage and press the ‘LOG IN’ button in order to open the small log in pop-up window where you also have the option to create a new online account.

Step 2: Click on the ‘Register’ button in order to open the online enrollment page.

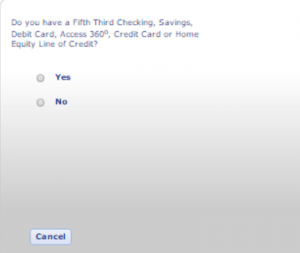

Step 3: Choose whether you already have a Fifth Third Bank line of credit or not.

Step 4: Select your account type and introduce your account number and social security number and select whether you have with you your loan documents. Then press ‘Get Started.’

FAQs

Q: What is Fifth Third Bank?

Fifth Third Bank pride itself on their community involvement since 1948. It is the financial institution in the United States with its headquarters in Cincinnati, Ohio at Fifth Third Center. The bank operates on branch banking, commercial banking, payment processing, investment advising, and title insurance and it was the first bank in the U.S. to establish a charitable foundation.

Q: How safe is Fifth Third Bank?

Fifth Third Bank, as an FDIC-insured bank, can be considered quite safe, since it has 17,695 full-time employees in 1,174 offices in multiple states. The U.S. bank customers currently have $104.81 billion in deposits which earns the bank 4 out of 5 stars for safety.

Q: Can I dispute a charge on my Fifth Third Platinum MasterCard credit card?

Yes, you can dispute any transaction on your Fifth Third Platinum MasterCard credit card and you can do that by calling Disputes Resolution Department at 1-877-833-6197. Once you are on the line, you will be asked to select the appropriate product Checking, Savings or Card and then the Disputes Option. The transaction information needs to be at your hand along with the reason for your dispute. Disputes Resolution Department Customer Service Professionals are available from Monday to Friday from 7 AM to 8 PM and on Saturday from 8:30 AM to 5 PM.

Permium Credit Card Offers

Compare Fifth Third Platinum MasterCard

Recently Compared With (by users)

Hilton Honors American Express Card

Hilton Honors American Express Card

Crate and Barrel Credit Card

Crate and Barrel Credit Card

Amex Blue Cash Everyday Credit Card

Amex Blue Cash Everyday Credit Card

AT&T Access More Citi Credit Card

AT&T Access More Citi Credit Card

Capital One® Venture® Rewards Credit Card

Capital One® Venture® Rewards Credit Card

Animal Friends Visa Credit Card

Animal Friends Visa Credit Card

Farm Sanctuary Credit Card

Farm Sanctuary Credit Card

Princess Cruises Rewards Visa Credit Card

See All Comparisons >>

Princess Cruises Rewards Visa Credit Card

See All Comparisons >>