How to Apply to Fifth Third Platinum MasterCard

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewWith its amazing cash back rewards and signup bonuses, the Fifth Third Platinum MasterCard might well be exactly the card you were always looking for. If you decide to get it, we are here to guide you through the process of filling in and submitting an online application form.

Requirements

Before applying for a Fifth Third Platinum MasterCard, please make sure that you meet all the criteria of eligibility/requirements listed below:

- Be at least 18 years of age

- Be a US citizen or a resident alien of the US with a valid US street address and a valid social security number

- Have a valid ID

- Have a valid email address and phone number

- Be ready and open to answer personal data questions

How to Apply

If you decide to apply for a Fifth Third Platinum MasterCard, here are the steps to follow for completing and submitting an online application form:

Step 1: Open the credit card’s homepage and click on the ‘APPLY NOW’ button for opening the online application form.

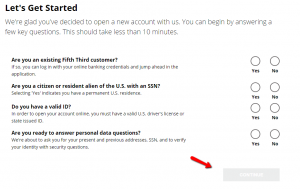

Step 2: Answer with ‘yes’ or ‘no’ the following questions: Are you an existing Fifth Third customer? Are you a citizen or resident alien of the U.S. with a social security number? Do you have a valid ID? Are you ready to answer personal data questions? After answering all of these questions press ‘CONTINUE.’

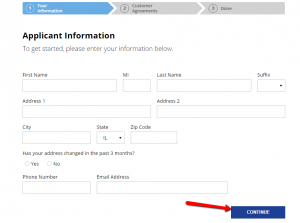

Step 3: Provide information about yourself including the following: first name, middle initial, last name, suffix, address 1, address 2, city, state, Zip code, whether your address changed or not in the past 3 months, phone number, email address and click on the ‘CONTINUE’ button.

Step 4: Read carefully and review the Customer Agreements forms and, should you agree with all the terms and conditions associated to this credit card, you can finally submit your online application.

FAQs

Q: Why do I need to confirm the electronic consent?

Consent is a very important concept in terms of data protection and it needs to be signed if it is in a paper form or confirmed if it is paperless, that is an electronic one on the bank online platform. Considering the fact that all credit card issuers are obliged by the Federal Law to collect personal information from people, the consent is obligatory and necessary representing your agreement with the data written on the document.

Q: What does it mean to “log in”?

If you want to enter your account via online banking system, you need to log in. that means that you need to provide your ID and password, which allows you to get access to your account information, after identifying you as the real cardholder. On online banking websites, there is a special field, where “login” is written, so you just need to visit the site, click on that field, and fill in the information that you are asked.

Q: Are my name and the name on the card different things?

Usually, people put the name on the card as their real name is and when filling in the personal information online, they just need to put their name as it is. However, some people put a version of the name which is not the same as their real name to be written on the card. That versions might be both your name and surname, or even the middle letter. That is why the system asks you to enter it exactly as it is written on the card. If you enter the wrong name, the card will not be accepted for security reasons.

Permium Credit Card Offers

Compare Fifth Third Platinum MasterCard

Recently Compared With (by users)

Military Star Credit Card

Military Star Credit Card

Loft Credit Card

Loft Credit Card

Princess Cruises Rewards Visa Credit Card

Princess Cruises Rewards Visa Credit Card

Westpac Altitude Black Credit Card

Westpac Altitude Black Credit Card

Costco Anywhere Visa® Credit Card

Costco Anywhere Visa® Credit Card

American Express Blue Card

American Express Blue Card

Boscov’s Credit Card

Boscov’s Credit Card

Capital One® Quicksilver® Cash Rewards Credit Card

See All Comparisons >>

Capital One® Quicksilver® Cash Rewards Credit Card

See All Comparisons >>