How to Apply to Frontier Airlines World MasterCard® Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewApplying for a Frontier Airlines Credit card (No Annual Fee) is convenient and hassle free! To sign up and enjoy the perks of being a cardholder, follow the steps provided below.

Requirements

To apply for a Frontier Airlines Credit Card, you have to comply with the following:

- You will have to provide your name, street address, date of birth, social security number, and other identification documents

- You have to be at least 18 when you apply

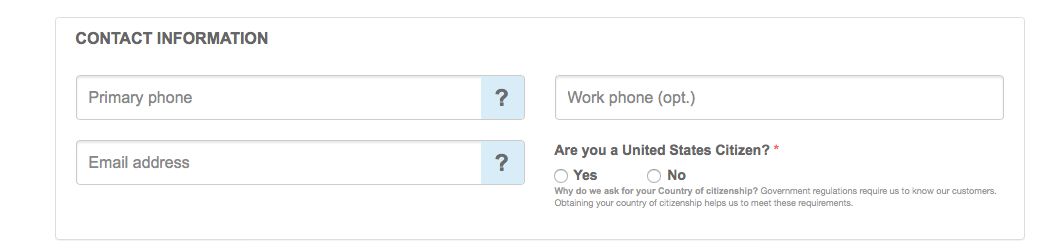

- Provide information regarding your country of citizenship.

How to Apply

Step 1: Access the Frontier Airlines Credit card homepage through the link.

Once on the homepage, there are two cards to choose from, choose the one that reads Frontier Airlines (No Annual Fee) Credit Card and then press on the “apply” button.

Step 2: In the application page, you will be asked to provide some General Information

- First name, middle initial, last name, suffix (if any)

- Permanent address

- Apartment / suite/ building (optional)

- City

- State

- Zip code

- Years / months at current address

- Residence status

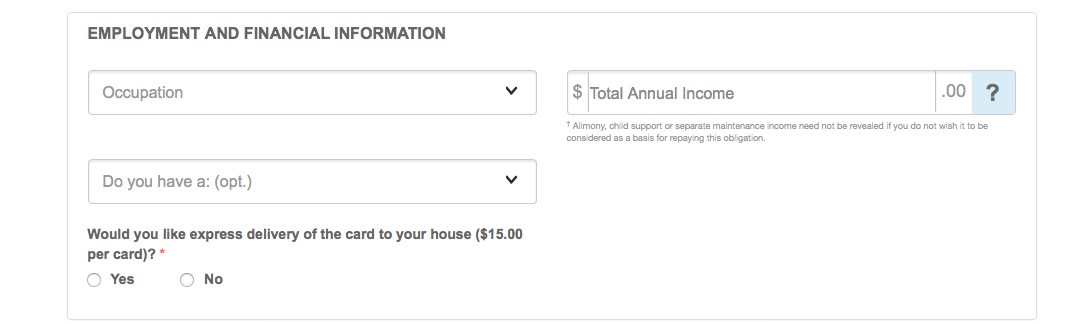

Step 3: Provide your employment and financial information

- Occupation

- Total annual income

- Specify from a drop-down list if you have either a savings account, savings and checking account or a checking account

Step 4: Provide your contact information

- Phone number (work phone and primary phone)

- Email address

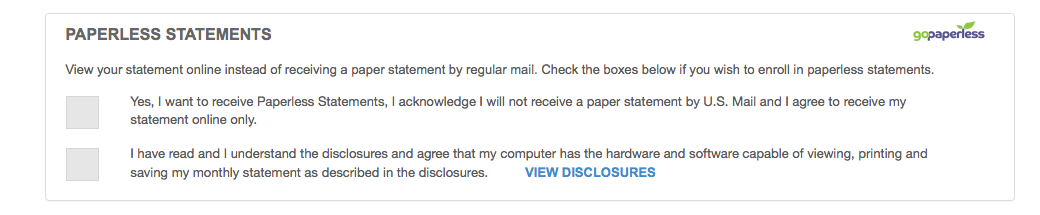

Step 5: click on the box if you would like to enrol in paperless statements.

Keep in mind that you need to have the necessary system information needed to receive your statement through email notification.

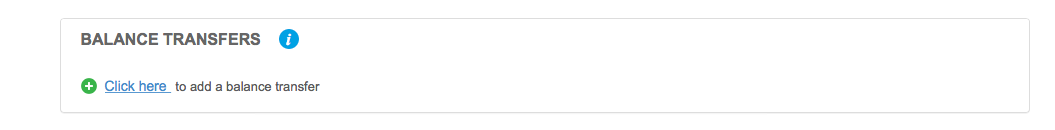

Step 6: You may opt to do a balance transfer from your existing credit card to your new Frontier Airlines Credit Card.

Provide your existing credit card’s number and the amount you wish to transfer and click on Add an Additional Balance transfer.

You may opt to skip this portion.

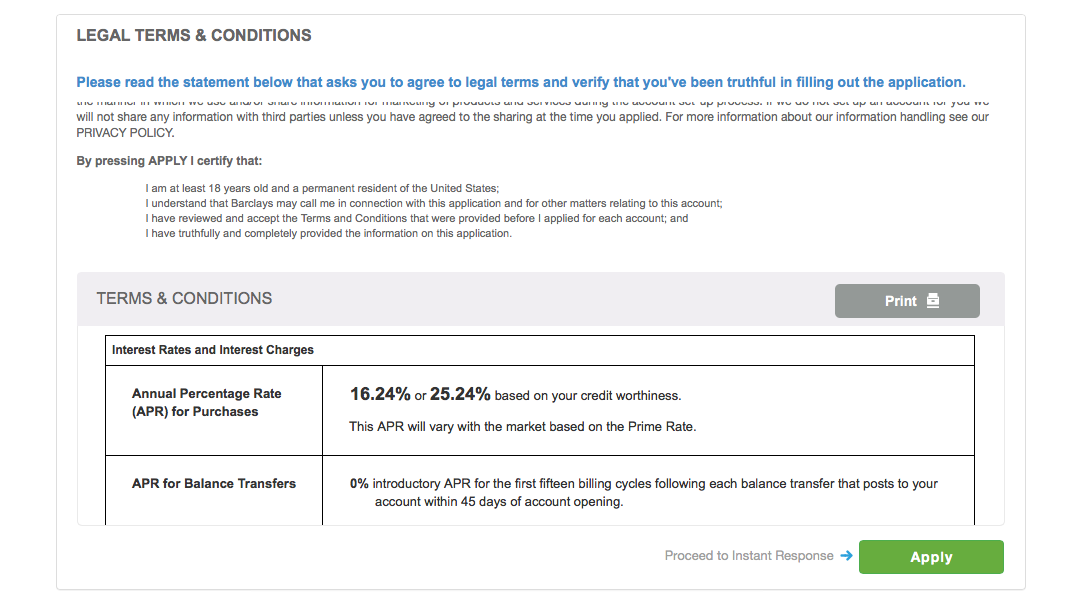

Thoroughly read and understand the terms and conditions. If you agree, click on Apply and follow the prompts.

Thoroughly read and understand the terms and conditions. If you agree, click on Apply and follow the prompts.

FAQs

Q: I used my Frontier credit card to book my flight. Do I get benefits such as free baggage check or early boarding?

Unfortunately, these are not the features that go with your Frontier Airlines (No Annual Fee) Credit card. The travel protection benefits that are available with the card are Trip Delay Reimbursement which provides up to $500 per ticket for expenses if a trip is delayed more than 12 hours, the Trip Cancellation coverage which provides up to $5,000 per person, per trip, for the non-refundable travel expenses such as fares and hotels that you have to cancel and Baggage Delay coverage with $100 per day for up to five days when your bags are delayed. Some other travel advantages when using this card are the Lost Luggage Reimbursement policy in case your luggage is lost or stolen and the Emergency Evacuation and Transportation Coverage which covers medical services and transportation if you or a member of your family are injured or become sick during a trip.

Q: What does eligible dining purchase include?

Since you have the chance to earn points for the dining paid by the Frontier Airlines (No Annual Fee) Credit card, you should know that the eligible dining includes meals and drinks in fast food, sit-down restaurants and bars or taverns.

Permium Credit Card Offers

Compare Frontier Airlines World MasterCard®

Recently Compared With (by users)

UMB Visa Credit Card

UMB Visa Credit Card

Best Western Rewards MasterCard

Best Western Rewards MasterCard

AgFed Credit Union Secured Visa Credit Card

AgFed Credit Union Secured Visa Credit Card

Amex Everyday Credit Card

Amex Everyday Credit Card

Starwood Preferred Amex Credit Card

Starwood Preferred Amex Credit Card

The Platinum Card® from American Express

The Platinum Card® from American Express

JetBlue Credit Card

JetBlue Credit Card

Elvis Presley Credit Card

See All Comparisons >>

Elvis Presley Credit Card

See All Comparisons >>