How to Apply to Gander Mountain Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewAn awesome card for everybody who loves to spend time outdoors, the Gander Mountain Credit Card offers many rewards and benefits to its holders. If you would like to get one of these cards, we are here to guide you through the online application process.

Requirements

If you are interested in applying for a Gander Mountain Credit Card, make sure you meet all the following requirements/eligibility criteria:

- You must be at least 18 years of age

- You must have a valid photo ID issued by the U.S. government

- You should have a valid U.S. Social Security Number

- You must be a legal resident of the United States with a valid street, rural route or APO/FPO posting address. PO mailing addresses are NOT accepted

- You should have a valid phone number and email address

- You should be employed and willing to provide details regarding your income

How to Apply

Here are the necessary steps you need to take in case you would like to apply for the Gander Mountain Credit Card:

Step 1: Go to the card’s main web page and click on the ‘APPLY TODAY’ button. This will lead you immediately to the online application form.

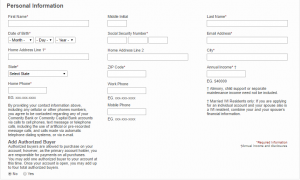

Step 2: Introduce in the appropriate fields details regarding your personal information such as first and last name, date of birth, social security number, email address, mailing address, home,work and mobile phone number, annual income and choose whether you would like to add another authorized buyer or not.

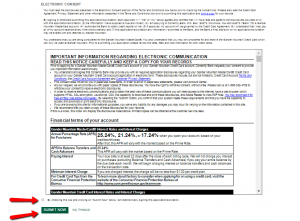

Step 3: Read carefully the important information about opening an account.

Step 4: Read carefully and review the Terms and Conditions regarding Electronic Consent, the important information regarding electronic communication and the financial details of your account, and provided that you agree with all of this, check the appropriate box and click on the ‘SUBMIT NOW’ button.

FAQs

Q: Who is Gander Mountain Credit Card good for?

The good sides of the Gander Mountain Credit Card are only for those are outdoor enthusiasts and shop regularly at Gander Mountain or Overtons.com. It is useful in terms that it gives them a chance to qualify for major rewards and make use of the programs offered by the credit card issuer or the store itself. Also, people who spend a lot of money on gas and groceries and are fond of getting their rewards in Gander Mountain cash certificates are a perfect match for this credit card.

Q: What are the Gander Mountain Credit Card benefits and why should I take it?

The Gander Mountain MasterCard is associated with a store with certain rewards that can be redeemed in the store or online official website. You can get a $40 rewards when you spend $500 on your newly opened card with at least one purchase made outside the store and additional $20 Rewards when you spend $500 in gas within the first two months. The $20 Rewards Certificate is given after reaching 2,000 points. When the purchases within the store are in question, no matter whetehr it was Gander Mountain and Overton purchases online and offline, card holders can earn 3 points per dollar spent. If you buy gas and groceries using your Gander Mountain MasterCard credit card, you can earn 2 points per dollar. All the other purchases offer you 1 point per dollar spent.

Permium Credit Card Offers

Compare Gander Mountain Credit Card

Recently Compared With (by users)

Dick’s Sporting Goods Credit Card

Dick’s Sporting Goods Credit Card

Home Depot Credit Card

Home Depot Credit Card

Peebles Credit Card

Peebles Credit Card

Dillard’s Credit Card

Dillard’s Credit Card

Good Sam Camping World Visa Credit Card

Good Sam Camping World Visa Credit Card

Gold Delta SkyMiles® Credit Card from American Express

Gold Delta SkyMiles® Credit Card from American Express

Wells Fargo Home Rebate Visa Card

Wells Fargo Home Rebate Visa Card

First Savings Credit Card

See All Comparisons >>

First Savings Credit Card

See All Comparisons >>