How to Apply to Gordmans Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewDue to the many benefits this card offers to its holders, including generous signup bonuses and the possibility to earn double reward points, the Gordmans Credit Card is a great option, especially for frequent shoppers. On this page, we’ll teach you how to fill in an online application for this card.

Requirements

Here are the requirements/criteria of eligibility you need to meet in order to be able to apply for this card:

- You must be at least 18 years of age

- You should have a valid photo ID issued by the government of the United States

- You must have a valid U.S. Social Security Number

- You must be a U.S. legal permanent resident, currently residing in the United States

- You should have a street, rural route or APO/FPO valid mailing address, as well as a valid email address and phone number

- You should be willing to provide details about your financial situation (annual income)

How to Apply

In case you are interested in applying for this card here are the necessary steps you should take for completing and submitting the online application:

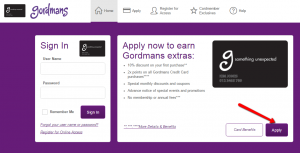

Step 1: Go to the credit card’s Sign In page and click on ‘Apply’ for opening the page containing the online application form.

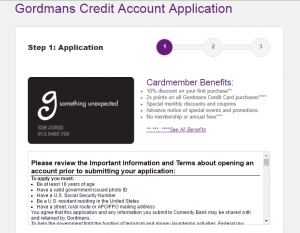

Step 2: Read details about the benefits this card offers to its holders, as well as the Important Information and Terms about opening an account.

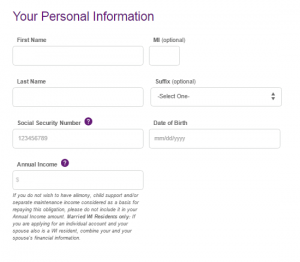

Step 3: Introduce your personal information, including your first and last name, social security number, date of birth, annual income, and optionally, your middle initial and suffix.

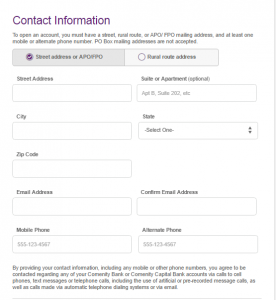

Step 4: Provide your contact information, including mailing address (street, city, state, Zip code and, optionally, suite or apartment), email address, mobile phone and alternate phone.

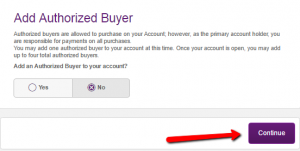

Step 5: Choose whether you would like to add another authorized user and click on ‘Continue’ to submit your online application.

FAQs

Q: I damage my credit card and now I cannot see the numbers on it. What should I do?

Damaging a credit card is a very frequent occurrence, especially if it is often used. If this happens, you may ask for card replacement via online services or coming to the bank itself. You will be given the new card within a few days form the application and all your rewards and credit will be replaced, so you do not need to worry at all.

Q: What does a toll-free customer service stand for?

Customer service that most of banks offer is usually toll-free, which means that you can call the service on the phone numbers provided on the site or at the back of your card, without being charged a fee for the call. They are made to provide the customers with the ability to contact the bank in case of some issues with their credit cards or account, and not to pay for that service, considering the fact that they might need to wait for quite long for the professional to answer their call, and after that, the process of explaining the issue might take even more time. If you do not want to waste your time on the phone, you can always visit the bank’s branch and talk to the representative.

Permium Credit Card Offers

Compare Gordmans Credit Card

Recently Compared With (by users)

Amex Blue Sky Credit Card

Amex Blue Sky Credit Card

Barnes and Noble Credit Card

Barnes and Noble Credit Card

ASU Platinum Credit Card

ASU Platinum Credit Card

Miles and More Premier World Mastercard

Miles and More Premier World Mastercard

Chase Amazon Credit Card

Chase Amazon Credit Card

Frontier Airlines Credit Card

Frontier Airlines Credit Card

Best Western Rewards MasterCard

Best Western Rewards MasterCard

Affinity Credit Union Choice Rewards World Elite Mastercard

See All Comparisons >>

Affinity Credit Union Choice Rewards World Elite Mastercard

See All Comparisons >>