How to Apply to Lowe’s Business Rewards Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewThe Lowe’s Business Rewards Credit Card issued by the American Express Bank is a great option for earning rewards points from your business spending at U.S. restaurants and Lowe’s stores. This card has no annual fee and good rates for the purchases APR.

Requirements

Before applying for a Lowe’s Business Rewards Credit Card make sure you meet the following criteria of eligibility:

- Be at least 18 years old

- Be the owner or the legal representative of a U.S. based business company/corporate/partnership with a valid federal tax ID

- Have a valid social security number, home address and phone number

- Be open to provide information relative to the business name, address, annual business revenue, estimated monthly spending and number of employees

- Be open to provide information relative to your monthly income

How to Apply

If you are interested to apply for a Lowe’s Business Rewards Credit Card, on this page we will guide you step by step through the online application process.

Step 1: Go to the card’s homepage and click on the ‘Apply’ button for opening the online application form.

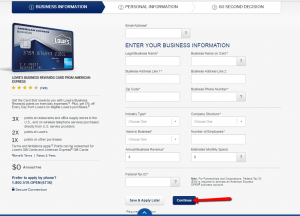

Step 2: Enter the required information regarding your business including: email address, the legal business name, the business address line, city, state, Zip code, business phone number, industry type, company structure, years in business, number of employees, annual business revenue, estimated monthly spending, and federal tax ID. After completing all the mandatory fields, click on the ‘Continue’ button.

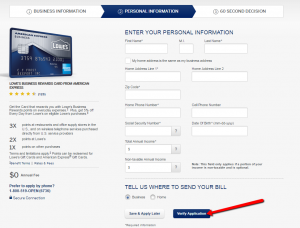

Step 3: Introduce your personal information including your: first and last name, home address, date of birth, Social Security Number, email address, primary phone number and total annual income. Choose the mailing address between your provided home or business ones. Click on the ‘Verify Application’ button to continue.

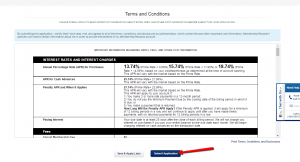

Step 4: In the next page you can review and edit your provided information. Make sure to read the Terms and Conditions related to this card and, if you agree with them, click on the ‘Submit Application’ to forward the request to the American Express Bank and receive a confirmation.

FAQs

Q: What should I do in order to validate my account?

Validating an account means that you need to prove that you actually possess the account when shopping online. This is used because the merchants cannot be sure of the validity of your card when you shop online. The process of validations consists of running a computer algorithm that performs calculations using a credit card's number and determine whether the card is valid or not. You only need to provide the credit card number and your credentials to prove that you are really the person that owns the account.

Q: What is included in monthly housing payments and how to calculate it?

When you decide to buy a house, you should understanding what your mortgage payment will be and this needs to be considered when contemplating one’s housing costs. All the payments for a home buyer include total Principal, Interest, Tax and Insurance payment per month, including mortgage principal and interest payments, hazard insurance premiums, property taxes and homeowner's association fees, plus monthly debt service. There are numerous calculators online which determine your monthly housing payment according to the data that you provide. It is advisable to determine your monthly payments before buying the house since taking these costs into consideration is important in order not to lead to unexpected payment shock when it is too late.

Permium Credit Card Offers

Compare Lowe’s Business Rewards Credit Card

Recently Compared With (by users)

Alliant Visa Platinum Rewards Credit Card

Alliant Visa Platinum Rewards Credit Card

New York and Company Credit Card

New York and Company Credit Card

Chadwicks Credit Card

Chadwicks Credit Card

Citi® / AAdvantage® Executive World Elite™ Mastercard® Credit Card

Citi® / AAdvantage® Executive World Elite™ Mastercard® Credit Card

76 Personal Credit Card

76 Personal Credit Card

Dressbarn Credit Card

Dressbarn Credit Card

Continental Finance Surge Credit Card

Continental Finance Surge Credit Card

Bank of America® Travel Rewards Visa® Credit Card

See All Comparisons >>

Bank of America® Travel Rewards Visa® Credit Card

See All Comparisons >>