Maurices Credit Card Login | Make a Payment

Card Info

Card Info

Application

Application

Card Rating

Share Your Opinion

Review this card now and let others know your thoughts.

Click here to leave a reviewIf you are using Maurices Credit Card you should never worry about the late payment fees and missed payments. Why? Because Maurices cares about it’s cardholders and always trying to make the billing process better. There is an online banking system that will make your life easier. We will show you how to use it.

How to Login / Make a Payment

Step 1 – Click on the link. In the middle of the page you will see: ‘To login or register, click here’. Click on that button.

Step 2 – The system will ask you to enter your User Name and your Password. Write down the required information and press ‘Sign in’.

If you have any problem with the access to your account, call 1-866-880-4385 and get an assistance.

If you have any problem with the access to your account, call 1-866-880-4385 and get an assistance.

Forgot Password / Username

Step 1 – On the Maurices website press on the ‘click here’ button.

Step 2 – Choose ‘Forgot your Username or Password?‘ right under the log in form.

Step 3 – Next step is filling an application form. Write down your Credit Card Account Number or Username.

You can find your account number on your card or monthly statement. If you can’t, type the user name you got after the registration in Account Center. Then enter your Zip Code, select the type of identification.

It can be your SSN, Federal Tax ID or passport number. After that enter the last 4 digits of your SSN. Press ‘Find My Account’.

Activation / Registration

If you do have a Maurices Credit Card, but you still don’t have an online managing account, do these simple steps.

Step 1 – Go to the website. Press the button ‘Click here’.

Step 2 – Select ‘Register for Online Access’, located under the log in form.

Step 3 – Enter the information you have provided when you were applying for the Maurices Credit Card and click ‘Find my account’.

Step 4 – Enter your username, password (don’t forget to confirm it), your E-mail address and your contact phone number.

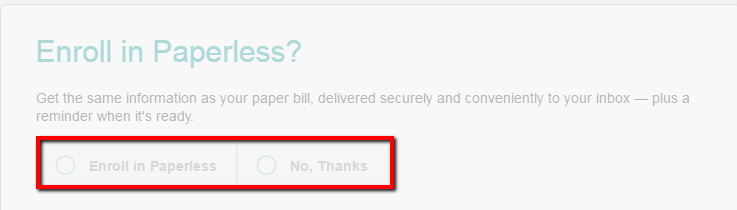

Step 5 – Choose one of the following options and press ‘Continue‘.

FAQs

Q: What does interest deferral policy stand for?

Deferred interest is the amount of interest you add to the loan when the planned payment is allowed to be made that is less than the interest due. It is a mortgage loan that allows the borrower to make minimum payments that are less than the entire amount of interest owed. In case a loan's balance increases due to the deferred interest, it is called a negative amortization.

Q: What is the difference between APR rates and an interest rate?

APR stands for the annual percentage rate and it includes not only the interest rate, but also the mortgage broker fees, discount points and other charges that you pay using your account. On the other hand, the interest rate refers only to the cost of borrowing the primary loan.

Q: What does the initial purchase amount stand for?

When you are starting a new account, you need to have the first investment amount. That first amount is called the initial purchase, and it indicates the smallest amount a fund will accept to establish a new account. There are some monetary restrictions for the minimum purchase amount and if you know in advance how much money you have to invest, that helps you limit your search.

Permium Credit Card Offers

Compare Maurices Credit Card

Recently Compared With (by users)

Animal Friends Visa Credit Card

Animal Friends Visa Credit Card

Total Visa Unsecured Credit Card

Total Visa Unsecured Credit Card

Old Navy Visa Credit Card

Old Navy Visa Credit Card

Chevron Premium Credit Card

Chevron Premium Credit Card

Diamond Resorts Credit Card

Diamond Resorts Credit Card

Bank of America® Travel Rewards Visa® Credit Card

Bank of America® Travel Rewards Visa® Credit Card

Fifth Third Business Rewards Credit Card

Fifth Third Business Rewards Credit Card

Barneys New York Credit Card

See All Comparisons >>

Barneys New York Credit Card

See All Comparisons >>