How to Apply to Merrill Lynch Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewApply now for a Merrill Lynch credit card, one of the world’s most premier card. Join the ranks of the elite who own this card, and enjoy the exclusive benefits that this card offers.

Requirements

In addition to additional eligibility requirements for the Merrill Lynch credit card, you have to meet the following basic requirements:

- You must be at least 18 years old or older

- Must be a U.S. Citizen living in the United States

- Have a U.S. Social Security Number

How to Apply

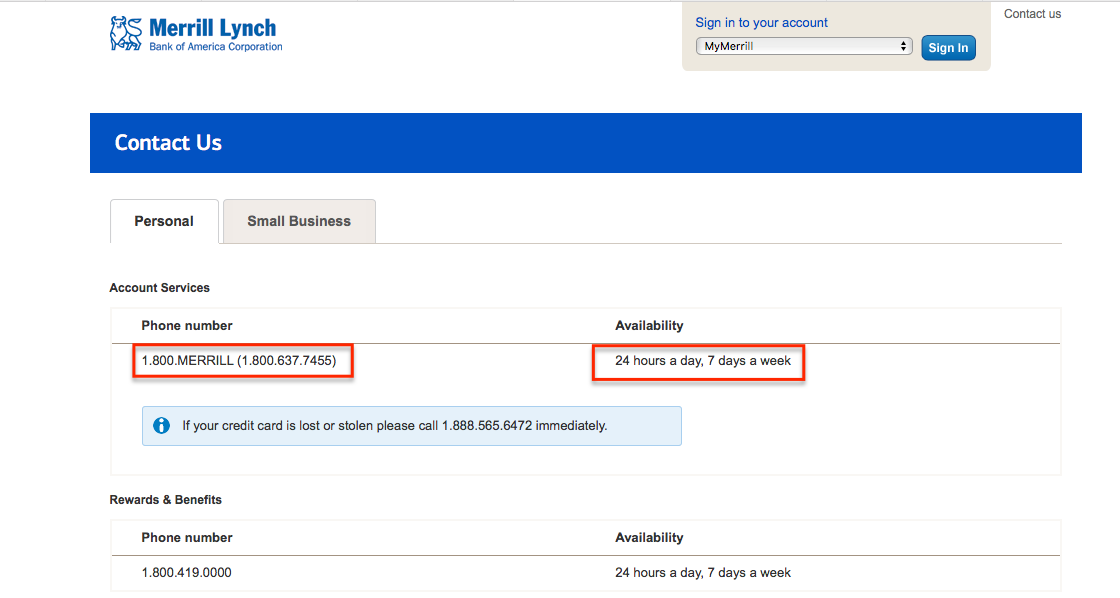

In line with its reputation as being one of the world’s premier card, an application to a Merrill Chase credit card can be started by calling their customer service hotline at 1-800-637-7455.

Their representatives are on a standby 24 hours a day, 7 days a week to answer your call.

You can ask them for information regarding eligibility, and whatever questions that you might have regarding the card.

Talking to a live representative will assure that your questions (if you have any) will be answered right away.

FAQs

Q: What is Merrill Lynch?

Merrill Lynch Wealth Management is a division of Bank of America and its headquarters are in New York City. Merrill Lynch has over 15,000 financial advisors. The firm has its origins in Merrill Lynch & Co., Inc. prior to 2009, but it agreed to be acquired by Bank of America. It offers investment management and financial services to its customers.

Q: What do the Luxury Travel Experiences include?

The owners of Merrill Lynch Visa credit card have a chance to experience Luxury travel benefits such as to shop anywhere with the card's smart chip technology, which allows the greater acceptance by merchants worldwide, exclusive discounts; they can spend $50,000 or more annually to achieve Plus Level status and they possess the Emergency Evacuation insurance, Auto Rental Collision Damage Waiver, Lost Luggage Reimbursement and Travel Accident Insurance.

Q: What are the protection features of Merrill Business Visa Signature credit card?

In order to protect your assets, Merrill Business Visa Signature credit card offers chip technology for added security, Zero Liability Protection, meaning you will not be held liable for fraudulent purchases made on your card, Terminated Employee Misuse Protection guards your business from misuse by an employee and other travel protections.

Permium Credit Card Offers

Compare Merrill Lynch Credit Card

Recently Compared With (by users)

UMB Visa Credit Card

UMB Visa Credit Card

Celebrity Cruises Visa Credit Card

Celebrity Cruises Visa Credit Card

Abercrombie and Fitch Credit Card

Abercrombie and Fitch Credit Card

Associated Bank Visa Bonus Rewards Credit Card

Associated Bank Visa Bonus Rewards Credit Card

ABNB Mastercard Platinum Credit Card

ABNB Mastercard Platinum Credit Card

AT&T Access More Citi Credit Card

AT&T Access More Citi Credit Card

USAA Rewards Visa Signature Card

USAA Rewards Visa Signature Card

The Blue Business® Plus Credit Card from American Express

See All Comparisons >>

The Blue Business® Plus Credit Card from American Express

See All Comparisons >>