How to Apply to State Farm Bank Business Visa Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewWith its surprising benefits and low rates, the State Farm Bank Business Visa Credit Card might be perfect if you are a business owner looking for a competitive rate while earning points in the State Farm Loyalty Rewards program. Besides, the card offers many travel and protection options, and a $0 annual fee.

Requirements

All applicants must:

- Be at least 18 years of age (does not apply to authorized users)

- Reside in the United States

- Be owners, managers or legal representatives of a business company (with a valid federal tax identification number)

How to Apply

There are three methods for applying for a State Farm Bank Business Visa Credit Card: contacting a participating State Farm agent, calling the State Farm Visa Application Center toll-free 800-324-4946, or completing an online application. In this guide we will focus on the latter, which is also the fastest method. Here is what you should do:

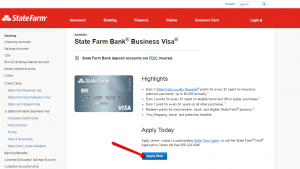

Step 1: From the card’s homepage click on the ‘Apply Now’ button to access the online application form.

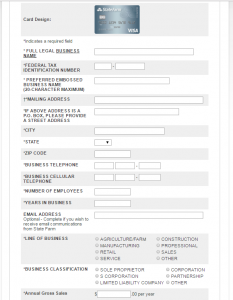

Step 2: Introduce in the provided boxes your business information including your: full legal business name, federal tax identification number, preferred embossed business name, mailing address, city, state, ZIP code, business phone number, number of employees, years in business, email address and annual gross sales. Select also the line of business and business classification from the available options in the form.

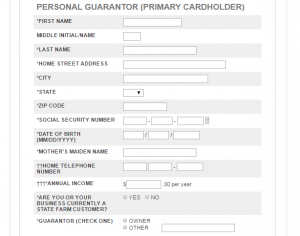

Step 3: Enter the Personal Guarantor’s (Primary Cardholder’s) information including: full name, home street address, city, state, ZIP code, Social Security Number, date of birth, mother’s maiden name, home phone number and the annual income amount.

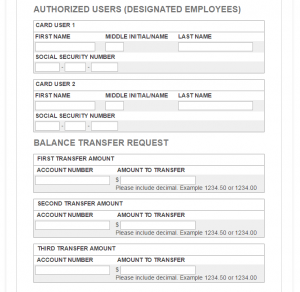

Step 4: Provide the information regarding the Authorized Users (max 2) by entering their full name and social security numbers in the appropriate fields. If you wish to request a balance transfer you can do it in this step by entering in the boxes provided the account numbers and the amount to transfer.

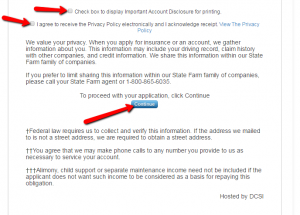

Step 5: Select the boxes related to the Important Disclosures and the Privacy Policy agreement and proceed with your application by clicking the ‘Continue’ button.

FAQs

Q: What kind of software is necessary to be able to see Online Documents?

First, in order to get to the document, you need to have any of the Internet browser programs such as Opera, Google Chrome or Mozilla. They need to be updated in order to achieve the perfect view of the pages. Then, the online documentation can be read and downloaded using Adobe Acrobat Reader. Adobe Acrobat Reader is often installed on most computers and other devices, but if you do not have it, you can download it easily from various websites.

Q: What is the difference between a business and personal card?

The biggest difference between the two types of cards is that the interest rates can change frequently and without notice with a business card and the law determines that personal cards have their fees and interest rates capped. For small business cards, you’re more likely to get rewards that are tailored toward business purchases. Personal consumer and small business cards are similar when trying to qualify and when you apply for both of them, your credit score will be inquired. Business credit cards affect business credit and sometimes personal credit, too and business credit limits tend to be higher than the personal one especially if you are making a lot of expensive purchases. Another difference is that you will earn different types of rewards.

Permium Credit Card Offers

Compare State Farm Bank Business Visa Credit Card

Recently Compared With (by users)

Walmart Credit Card

Walmart Credit Card

TJ Maxx Credit Card

TJ Maxx Credit Card

State Farm Student Visa Credit Card

State Farm Student Visa Credit Card

Plenti American Express Credit Card

Plenti American Express Credit Card

Wells Fargo Platinum Visa Card

Wells Fargo Platinum Visa Card

BankAmericard Better Balance Rewards Credit Card

BankAmericard Better Balance Rewards Credit Card

Citi Expedia Credit Card

Citi Expedia Credit Card

Abercrombie and Fitch Credit Card

See All Comparisons >>

Abercrombie and Fitch Credit Card

See All Comparisons >>