How to Apply to State Farm Good Neighbor Visa Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewWith its low purchases APR (which in the first year is 0%) and enhanced electronic security, the State Farm Good Neighbor Visa Credit Card can clearly be an option to consider. If you decide to get this credit card, we are providing on this page a step by step guide on how to fill in and submit an online application form.

Requirements

Before completing the online application, make sure you meet the requirements listed below:

- Be 18 years old or older

- Be a resident of U.S. with a valid mailing address and a valid social security number

- Have a valid email address and phone number

- Be willing to disclose information regarding your current financial status

How to Apply

If you decide to apply for a State Farm Neighbor Visa Credit Card, these are the steps you should follow in order to complete and submit an online application:

Step 1: Go to the credit card’s homepage and press ‘Apply Now’ in order to access the online application page.

Step 2: Introduce in the required fields your first name, middle initial (optional), last name, residence address, city, state, Zip Code, Social Security Number, date of birth, housing status (own or rent), home phone, cell phone (optional), mother’s maiden name, income, monthly housing payment and email address (optional).

Step 3: Choose whether you are already a State Farm customer or not, and provide your employer name, work phone, and occupation. Optionally, you can add another authorized user and enter his/her first name, middle initial and last name.

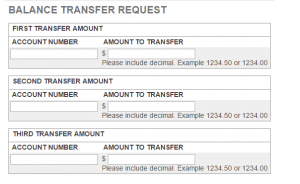

Step 4: Choose whether you would like to transfer your balances from other accounts (maximum three) and enter the account numbers as well as the amounts which you want to be transferred.

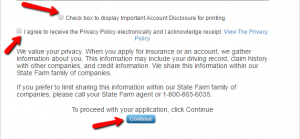

Step 5: Read carefully and review the terms and conditions associated to this card and, provided that you agree with all of them, check the appropriate box and click on the ‘Continue’ button to submit your application.

FAQs

Q: What is covered under the Personal Identity Theft benefit?

The costs that are covered under the Personal Identity Theft are the costs you experience for re-filing applications for loans, grants, or other credit or debt instruments that are rejected solely because the lender received incorrect information as a result of a Covered Stolen Identity Event, costs for long distance telephone calls to report a Covered Stolen Identity Event, costs experienced by you for a maximum of four credit reports, requested as a result of a Covered Stolen Identity Event and costs for reasonable fees for an attorney appointed by the Benefit Administrator.

Q: What is not covered under the Personal Identity Theft benefit?

The costs that are not covered under the Personal Identity Theft benefit are dishonest, criminal or fraudulent acts by the owner of the card, damages or loss, Costs associated with any legal action other than those set forth under Covered costs and costs that are result of theft or unauthorized use of an account by a person to whom the account has been entrusted.

Q: What does the concierge service stand for?

This is a service offered to cardholders by which a personal assistant performs certain tasks for you or gets results that you cannot find. Usually, other person researches the subject that you do not have time to research and then get back to you. Those are services related to booking your hotel, renting a car or doing any other activities. State Farm Good Neighbor Visa Credit card offer its holders concierge services and they might not have a high annual fee.

Permium Credit Card Offers

Compare State Farm Good Neighbor Visa Credit Card

Recently Compared With (by users)

Bealls Outlet Credit Card

Bealls Outlet Credit Card

Best Buy Credit Card

Best Buy Credit Card

Abt Electronics Credit Card

Abt Electronics Credit Card

Fifth Third Business Rewards Credit Card

Fifth Third Business Rewards Credit Card

Military Star Credit Card

Military Star Credit Card

AT&T Access Citi Credit Card

AT&T Access Citi Credit Card

Crate and Barrel Credit Card

Crate and Barrel Credit Card

Barnes and Noble Credit Card

See All Comparisons >>

Barnes and Noble Credit Card

See All Comparisons >>