How to Apply to U.S. Pride BankAmericard Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewThe U.S. Pride BankAmericard Credit Card is created for U.S. military, veterans or persons who want to show their U.S. pride while using their credit card. This card is a cash rewards opportunity to always have with you, it is simple to use and it has no annual fees.

Requirements

These are the requirements you need to fulfill before applying for the U.S. Pride BankAmericard Credit Card:

- Be a US resident

- Be 18 years of age or older

- Have a valid social security number or a tax identification number

How to Apply

Step 1: Navigate to the card’s main page and click on the ‘Apply Now’ button.

Step 2: Enter in the boxes provided the required personal information including your: full name, valid mailing address, and valid phone number.

Step 3: Provide also your financial information under the Employment & Finances section, including your annual income, source of income and your monthly housing payment. In case you would like to transfer your balance to your new card select the ‘Transfer a balance to my new credit card’ under the Additional options section.

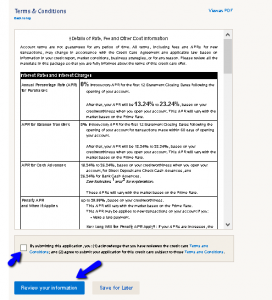

Step 4: After reading carefully the Terms & Conditions, make sure to check the box under this section (in doing so you agree to the conditions introduced in the Terms & Conditions section for this credit card). Complete your application by clicking on the ‘Review your Information’ button.

FAQs

Q: Why are the bank officers trying to convince me not to use paper statement anymore?

You should not think that they are trying to force you do something that is not good for you. Nowadays, banks and other card issuers are advising people to use paperless statement options which offer higher account security and reduce paper consumption. Paperless billing statements are completely the same as the paper ones, meaning that you will not get a credit card statement in the mail anymore, but it will be available online and you can download, save, and print it any time you want. However, if you are not satisfied with the paperless statement option, you can always go back to paper statements and receive it by mail again.

Q: How can I calculate the amount of my minimum payment?

You can calculate it, just as the card issuer, based on some rules in determining the minimum payment. People who have less than $15 balance, the minimum payment will be equal to their balance. On the other hand, if your balance is more than $15, the minimum payment will be 1% of your balance plus new interest and late payment fees.

Q: Does the U.S. Pride card have some relation to charity?

No, the card does not support charity even though it looks like the card that might contribute some of its income to charity institutions.

Permium Credit Card Offers

Compare U.S. Pride BankAmericard Credit Card

Recently Compared With (by users)

State Farm Rewards Visa Credit Card

State Farm Rewards Visa Credit Card

Dillard’s Credit Card

Dillard’s Credit Card

Wells Fargo Rewards Visa Card

Wells Fargo Rewards Visa Card

ABNB Visa Platinum Rewards Credit Card

ABNB Visa Platinum Rewards Credit Card

Alliant Visa Platinum Rewards Credit Card

Alliant Visa Platinum Rewards Credit Card

Bank of America® Travel Rewards Visa® Credit Card

Bank of America® Travel Rewards Visa® Credit Card

Upromise Mastercard Credit Card

Upromise Mastercard Credit Card

PNC CashBuilder Visa Credit Card

See All Comparisons >>

PNC CashBuilder Visa Credit Card

See All Comparisons >>