How to Apply to Wells Fargo Cash Wise Visa Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewWith its 1.5% cash back on all purchases and 1,8% for mobile wallet payments, the Wells Fargo Cash Wise Visa Credit Card offers decent earnings for consumers who are interested in winning rewards for the long-term. If you are interested in applying for this card, here we will show you how to fill in and submit an online application form.

Requirements

If you want to apply for this card, make sure you meet the following requirements:

- Be 18 years old or older

- Have a valid U.S. social security number, postal and email address and phone number

- Be open to providing information regarding your housing status and employment status (including monthly mortgage/rent rate and annual income)

- Have a Wells Fargo relationship (an account previously opened at this bank)

How to Apply

If you do not have a previous Wells Fargo relationship but would like to apply for a credit card, you may personally visit a location near you.

If you already have a Wells Fargo relationship (another account previously opened at this bank) and want to apply for a Wells Fargo Cash Wise Visa Credit Card, here is a step-by-step guide for filling in an online application:

Step 1: Visit the credit card’s homepage and click on the ‘Apply Now’ button.

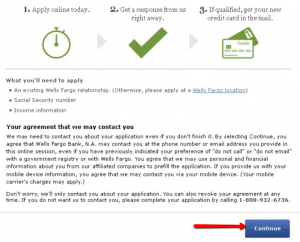

Step 2: In the next window, introduce your username and password (in case you already have them) for a faster, prefilled application form.

If not, scroll down to the bottom of the page and simply click ‘Continue’ to open the online application form.

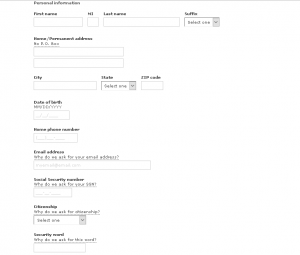

Step 3: Enter your personal information (first name and last name), home/permanent address (include also a city, state, Zip code), date of birth, home phone number, email address, social security number, citizenship and your chosen security word.

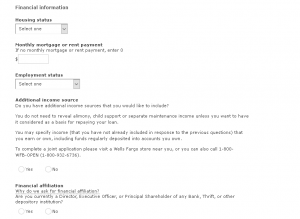

Step 4: Provide your financial information such as your housing status, monthly mortgage or rent payment, employment status, additional income sources and financial affiliation.

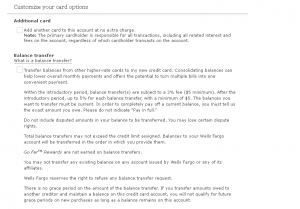

Step 5: If you’d like to customize your card options, you can add another card and choose whether you would like to transfer your balances from other accounts to your new card.

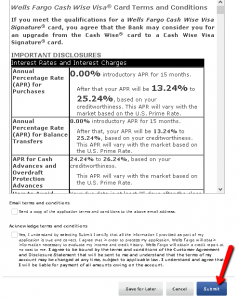

Step 6: Take a minute to read and review the terms and conditions associated to this card (also, choose whether you would like them to be sent to your email address or not), and agree with them by checking the appropriate box.

Finally, click on the ‘Submit’ button.

FAQs

Q: Is it a wise thing to request a credit limit increase with Wells Fargo credit cards?

The credit limit increase always has its good or bad sides, and if you decide to request a credit limit increase you should bear in mind that it will trigger a hard check on your credit, which can lower your credit score and the advantage of lowering your credit utilization to improve your credit score would disappear. Actually, the more you spend, the harder it will be to pay off the credit card each month, which might lead to credit card debt. On the other hand, there are some positive sides of requesting a credit limit increase but only if you have already proven yourself as a valued and responsible customer. This means that it will be easier to request and receive an increased credit line unlike applying for a brand new line of credit. Second, if you get approved of the credit limit increase it will make your credit score even better.

Q: If I have doubts about Wells Fargo Cash Wise Visa Card, where can I find the Terms and Conditions?

You can always go to the nearest issuer branch or Wells Fargo store and ask for details some of the employees. If you do not want to lose time going there, you can simply view the Wells Fargo Terms and Conditions online on the Wells Fargo official website.

Permium Credit Card Offers

Compare Wells Fargo Cash Wise Visa Card

Recently Compared With (by users)

Petland Credit Card

Petland Credit Card

Frontier Airlines World MasterCard®

Frontier Airlines World MasterCard®

Zions AmaZing Rewards Credit Card

Zions AmaZing Rewards Credit Card

Brooks Brothers Credit Card

Brooks Brothers Credit Card

Upromise Mastercard Credit Card

Upromise Mastercard Credit Card

HSN Credit Card

HSN Credit Card

ASU Rewards Credit Card

ASU Rewards Credit Card

Hawaiian Airlines Credit Card

See All Comparisons >>

Hawaiian Airlines Credit Card

See All Comparisons >>