How to Apply to Wells Fargo Home Rebate Visa Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

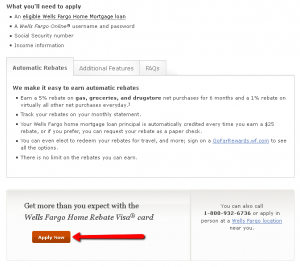

Click here to leave a reviewThe Wells Fargo Home Rebate Visa Card offers an amazing opportunity to earn rebates (%5 on gas, grocery and drugstores and 1% on other purchases) which are automatically converted to cash rewards of $25 increments to your qualifying Wells Fargo Home Mortgage principal balance. Read below on how to apply for this card.

Requirements

Pay attention to the following eligibility criteria before applying for the Wells Fargo Home Rebate Visa Card:

- You must be 18 years old or older

- Must have a valid U.S. social security number, postal and email address and phone number

- You should already have an eligible Wells Fargo Home Mortgage loan

- You must have previously created your Wells Fargo Online username and password

- Must provide your income information

How to Apply

If you already have a loan account previously opened at Wells Fargo bank along with an existing online account (including username and password) and want to apply for a Wells Fargo Cash Home Rebate Visa Credit Card, here you can find information on completing your online application:

Step 1: First you should navigate to the credit card’s webpage. Here you will find and must click on the ‘Apply Now’ button.

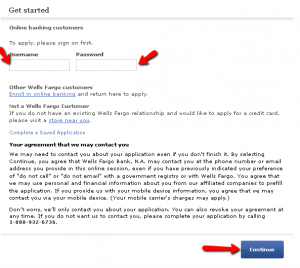

Step 2: Next, you need to introduce your username and password, since this is required in order to complete a Wells Fargo Cash Home Rebate Visa Credit Card application. After providing your username and password, scroll down to the bottom of the page and click on the ‘Continue’ button.

This will open the online application form.

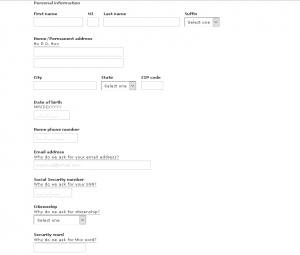

Step 3: If needed, update your personal information including your first name and last name, home/permanent address, city, state, Zip code, date of birth, home phone number, email address, social security number, citizenship and your chosen security word.

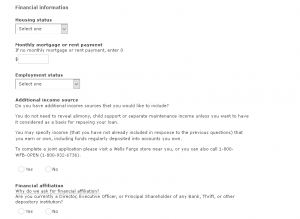

Step 4: Update your financial information related to your housing status, monthly mortgage, employment status, additional income sources and financial affiliation.

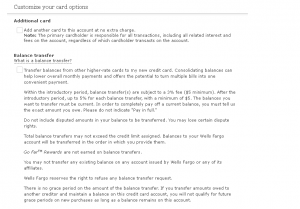

Step 5: You can add another cardholder and choose whether you would like to transfer your balances from other accounts to your new card.

Step 6: The final step includes reading carefully and agreeing to the terms and conditions of this card.

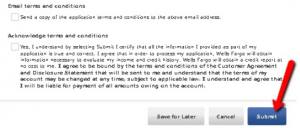

You need to check the appropriate box for acknowledging your agreement with these terms and conditions.

To conclude your application, click on the ‘Submit’ button.

FAQs

Q: Who is the Wells Fargo Home Rebate Visa Card designed for?

The Wells Fargo Home Rebate Visa Card is designed for Wells Fargo mortgage customers. Even though it has a generous sign-up bonus and cash back rewards, the default redemption option is to apply these rewards toward the cardholder’s Wells Fargo mortgage balance. However, if you are not interested in mortgage payoff, the Home Rebate Visa permits cardholders to redeem for cash and a variety of non-cash rewards offered through the Go Far Rewards portal.

Q: What are the disadvantages of the Wells Fargo Home Rebate Visa Card?

The first disadvantage is that the cardholders must have Wells Fargo Mortgages. Besides the fact that Wells Fargo is one of the largest banks around, not so many homeowners are Wells Fargo mortgage customers. If you are already a Wells Fargo mortgage customer, this is a useful card, but if you are not, the card might not be the perfect choice for you. Secondly, rewards are minimal and there is $25 Minimum Redemption Threshold which is not good for infrequent card users, who may take months to reach redemption. High Foreign Transaction Fee of 3% foreign is the major disadvantage for frequent overseas travelers.

Permium Credit Card Offers

Compare Wells Fargo Home Rebate Visa Card

Recently Compared With (by users)

Fifth Third Business Rewards Credit Card

Fifth Third Business Rewards Credit Card

Affinity Credit Union Low Fee Choice Rewards MasterCard

Affinity Credit Union Low Fee Choice Rewards MasterCard

Chadwicks Credit Card

Chadwicks Credit Card

NHL Discover it Credit Card

NHL Discover it Credit Card

Best Western Rewards MasterCard

Best Western Rewards MasterCard

American Kennel Club Visa Credit Card

American Kennel Club Visa Credit Card

ASU Platinum Credit Card

ASU Platinum Credit Card

Chevron VISA Card

See All Comparisons >>

Chevron VISA Card

See All Comparisons >>