How to Apply to Wells Fargo Home Rebate Visa Signature Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewThe Wells Fargo Home Rebate Visa Signature Card gives you the possibility to earn rebates that are automatically applied as cash rewards in $25 increments to your qualifying Wells Fargo Home Mortgage principal balance. If you want to apply for this card, below we will show you how to fill in and submit an online application form.

Requirements

If you want to apply for this card, you will need to possess the following requirements:

- Be 18 years old or older

- Have a valid U.S. social security number, postal and email address and phone number

- Have an eligible Wells Fargo Home Mortgage loan

- Already have your Wells Fargo Online username and password

- Be willing to provide your income information

How to Apply

If you do not have a previous Wells Fargo relationship but would like to apply for a credit card, you may personally visit a location near you.

If you already have an account previously opened at Wells Fargo bank along with an existing online account (including username and password) and want to apply for a Wells Fargo Cash Home Rebate Visa Signature Credit Card, here is a step-by-step guide for completing your online application:

Step 1: Go to the credit card’s homepage and click on the ‘Apply Now’ button.

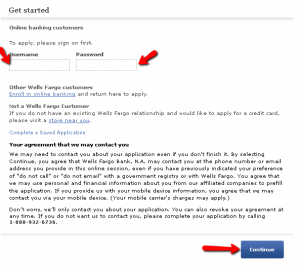

Step 2: In the next window, introduce your username and password, since this is mandatory for the Wells Fargo Cash Home Rebate Visa Signature Credit Card application (also, it will allow you to generate a faster, prefilled application form).

Next, scroll down to the bottom of the page and simply click ‘Continue’ to open the online application form.

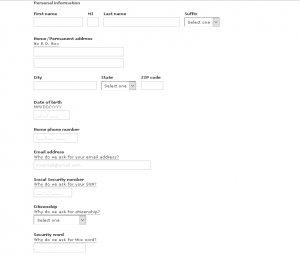

Step 3: Check and validate your personal information such as your first name and last name, home/permanent address, city, state, Zip code, date of birth, home phone number, email address, social security number, citizenship and chosen security word.

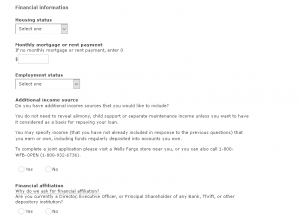

Step 4: Provide your most updated financial information including your housing status, monthly mortgage, employment status, additional income sources and financial affiliation.

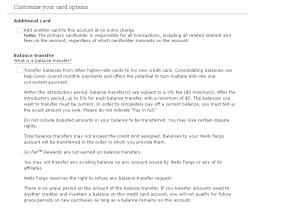

Step 5: If you’d like to customize your card options, you can add another card and choose whether you would like to transfer your balances from other accounts to your new card.

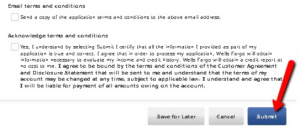

Step 6: Read and review the terms and conditions associated with this card (you can also choose if you would like to receive them by email), and check the appropriate box for acknowledging your agreement.

Click on the ‘Submit’ button to forward your application to the Wells Fargo bank.

FAQs

Q: What information is sent to the credit card bureaus?

When it comes to information reporting, Wells Fargo may report information about you to consumer reporting agencies, such as account history, account performance, account status, violations of your account or the terms of Agreement. You have the right to dispute the accuracy of the information by writing at Wells Fargo Credit Bureau Dispute Resolution, P.O. Box 14517, Des Moines, IA 50306-3517.

Q: What are the advantages of Wells Fargo Home Rebate Visa Signature Card?

First and very important advantage of the Wells Fargo Home Rebate Visa Signature Card is the possibility of turning everyday purchases into rebates that can help reduce your qualifying mortgage principal. You can also earn a 5% rebate on gas, groceries, and drugstore net purchases for 6 months and a 1% rebate on all other net purchases. Rebates are applied automatically as cash rewards to your Wells Fargo Home Mortgage every time you earn a $25 rebate. Greta option is that using rebates is flexible, so you can choose to use rebates toward travel, gift cards, merchandise, cash redemption, etc.

Q: What does Signature Card stand for?

Signature card is often related to business bank accounts which include the list of people who are authorized to sign checks and make changes to the account. Also, each person listed on the card is also required to sign it, so the bank has an example signature to compare future signatures with. In case of suspicious charges to the account, the simple look at the card and signature comparison solves the dilemma.

Permium Credit Card Offers

Compare Wells Fargo Home Rebate Visa Signature Card

Recently Compared With (by users)

Total Visa Unsecured Credit Card

Total Visa Unsecured Credit Card

Ducks Unlimited Visa Credit Card

Ducks Unlimited Visa Credit Card

Gander Mountain Credit Card

Gander Mountain Credit Card

Celebrity Cruises Visa Credit Card

Celebrity Cruises Visa Credit Card

Chevron VISA Card

Chevron VISA Card

Amex Everyday Credit Card

Amex Everyday Credit Card

BB&T Spectrum Rewards Credit Card

BB&T Spectrum Rewards Credit Card

Wells Fargo Propel American Express Card

See All Comparisons >>

Wells Fargo Propel American Express Card

See All Comparisons >>