How to Apply to Westpac Altitude Platinum Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewWith its amazing point reward systems and more than generous signup bonuses the Westpac Platinum Credit Card can be the card you’ve always wanted. Should you decide to apply for it, check out this page for details regarding the application process.

Requirements

Before starting to complete an online application form, you should make sure that you meet all the requirements/eligibility criteria listed below:

- Be 18 years old or older

- Legally reside in Australia

- Own a valid ID issued by the Australian authorities

- Have a valid email, postal/mailing address and a valid phone number

- Be open to provide during the application process details concerning your financial status (including your income and housing payments)

How to Apply

Should you decide to begin an application for this credit card, here are the steps you need to take to fill out and submit an online application form:

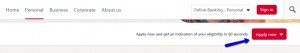

Step 1: On the credit card’s main web page press ‘Apply Now.’

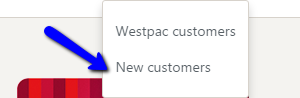

Step 2: Select whether you are a Westpac customer already or not, i.e. if you’re a new customer.

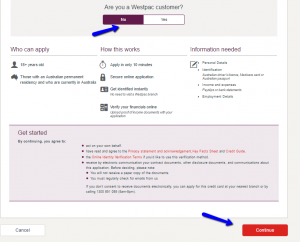

Step 3: On the following page you’ll be required to select again whether you are or not a Westpac customer and to press ‘Continue’ for finally getting access to the online application page.

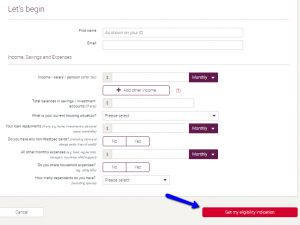

Step 4: Fill in the appropriate fields with your personal and financial information, including the following: first name and last name, email address, monthly income, savings and pension (following tax deduction), balances you have in savings/investment accounts (if any at all), housing status, and monthly loan repayments (if any). Then choose whether you have or not any other non-Westpac cards, provide further details about other possible monthly expenses including, for example, food, bills, transport, insurance, and child support, choose whether you share your household expenses with someone else or not, enter how many dependents (excluding your spouse) you have and finally click on the ‘Get my eligibility indication’ button. If you will be deemed eligible, you will also need to enter some further details including, among others, your mailing address and phone number before submitting your application.

FAQs

Q: Who is eligible for the Overseas Travel Insurance?

The owners of the Westpac Altitude Platinum Credit Card automatically become eligible for complimentary Overseas Travel Insurance cover. However, you need to meet the following criteria, meaning that you need to be a permanent Australian resident or you hold a current and valid 457 Visa and live in Australia, you spend at least $A500 on your travel costs before you leave Australia using one of your Altitude Black or Platinum cards, which might include return travel tickets, airport or departure taxes, overseas accommodation etc., you should have a return overseas travel ticket before leaving Australia and not be over 80 years of age when you first become eligible for this cover.

Q: How can the points balance be seen?

If you want to see your Altitude points balance, there is a chance of seeing it on most pages of the official website once you have logged in. You can go to the View Statement page where you can see the number of Altitude points earned on transactions at the applicable rate per dollar spent and details Bonus Partner transactions and bonus Altitude points earned and the total number of Altitude points available for Redemption. Or you can visit the Points Summary page which shows the number of Altitude points earned for the selected statement period, the number of Altitude bonus points earned for the selected statement period and the total points earned during the statement period.

Permium Credit Card Offers

Compare Westpac Altitude Platinum Credit Card

Recently Compared With (by users)

Gander Mountain Credit Card

Gander Mountain Credit Card

Pottery Barn Credit Card

Pottery Barn Credit Card

Zions AmaZing Low Rate Credit Card

Zions AmaZing Low Rate Credit Card

Wells Fargo Platinum Visa Card

Wells Fargo Platinum Visa Card

U.S. Pride BankAmericard Credit Card

U.S. Pride BankAmericard Credit Card

Westpac Altitude Credit Card

Westpac Altitude Credit Card

Petland Credit Card

Petland Credit Card

Best Western Rewards MasterCard

See All Comparisons >>

Best Western Rewards MasterCard

See All Comparisons >>