How to Apply to Westpac Low Rate Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewWith its low interest rates in the first year from opening an account and other signup bonuses the Westpac Low Rate Credit Card is a perfect option to help you trim your credit card costs. Should you decide to apply for this card, check out this page for further information regarding the application process.

Requirements

Before beginning an online application, check the following requirements to decide whether or not you are eligible to apply for this card:

- You should be at least 18 years of age or older

- Be a legal permanent resident of Australia

- Have a valid Australian ID

- Have a valid email address, phone number and mailing address

- Be open to provide details regarding your employment and financial situation (including income and housing rates)

How to Apply

If you decide to apply for this card, here are the steps you should follow to complete and submit an online application form:

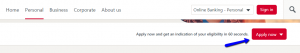

Step 1: Access the credit card’s home page and click on the ‘Apply Now’ button.

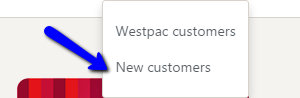

Step 2: Choose whether you already are a Westpac customer or a new customer.

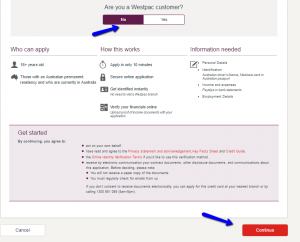

Step 3: On the following page you will be asked once more to select whether you already are a Westpac customer or not and to click on the ‘Continue’ button in order to finally open the online application page.

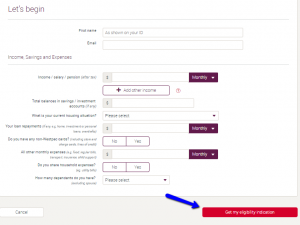

Step 4: Enter in the provide fields the following information: your first name, email address, monthly income, savings or pension (after tax deduction), total balances in savings or investment accounts (if any), your current housing situation, your monthly loan repayments (if any), select whether you have or not any non-Westpac cards, enter your other monthly expenses (e.g. food, regular bills, transport, insurance, child support), choose whether you share or not household expenses, select how many dependents you have (excluding your spouse) and press the ‘Get my eligibility indication’ button. Should you be considered eligible you will be asked some further details such as mailing address and phone number before submitting your application.

FAQs

Q: Who is eligible for the Westpac Low Rate Credit Card and what documentation is necessary?

The eligibility criteria are that you must be at least 18 years of age to apply and to be permanent Australian resident or Australian citizen. Also, you will need to have a good credit score with no signs of recent signs of bankruptcy and you will need to meet the minimum income requirements set by the Westpac. The required documentation is the proof of identity, such as Australian driver's license, Medicare card or Australian passport, your personal and financial details to assess your credit rating and source of income as well as employment details.

Q: Why credit cards should not be used?

Besides so many advantages of using credit cards, there are some disadvantages, but in comparison to the advantages, these can be considered insignificant. One of the disadvantages it that there is a chance of losing control if you do not pay off your debt in full every month. Another one is that the very high interest rates may hit and cause problems and the using of credit cards for cash withdrawals can be expensive, since you will have to pay a fee for every withdrawal.

Permium Credit Card Offers

Compare Westpac Low Rate Credit Card

Recently Compared With (by users)

Chase Ink Cash Business Credit Card

Chase Ink Cash Business Credit Card

Capital One® Secured Mastercard® Credit Card

Capital One® Secured Mastercard® Credit Card

Gander Mountain Credit Card

Gander Mountain Credit Card

Barnes and Noble Credit Card

Barnes and Noble Credit Card

Shell Platinum Credit Card

Shell Platinum Credit Card

Amex Blue Cash Preferred Credit Card

Amex Blue Cash Preferred Credit Card

Disney Premier Visa Card

Disney Premier Visa Card

Union Plus Credit Card Rate Advantage

See All Comparisons >>

Union Plus Credit Card Rate Advantage

See All Comparisons >>