How to Apply to Zions AmaZing Cash Back Business Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewZions AmaZing Cash Back Business Credit Card is definitely worth applying. First of all, you can enjoy generous cash back offer: get 1% or 2% back, depending on the purchase type. The card has no annual fee and not very high Purchase APR as well as no annual fee. In order to apply, follow our instructions.

Requirements

- Must provide Company’s Name and Address;

- Must be able to provide all the financial information;

- Must add the Guarantors (the exception is- non-profit organizations);

- Must have already existing Zions Checking or Savings Account.

How to Apply

Unfortunately, you can’t apply for Zions Business card online.

In order to apply, you have to fill out the application form and drop it in the local Zions location.

Step 1 – Click ‘Get Started’ button, placed on the right side of Zions Bank website.

Step 2 – You can save your time by completing your application at home.

On this page, you can download an application form.

In order to do it press ‘Download Application‘.

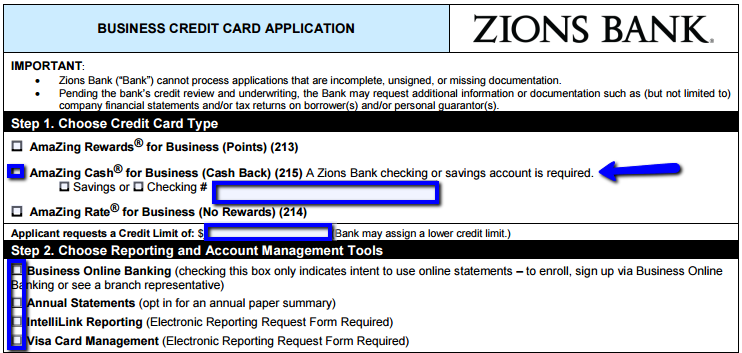

Step 3 – There is your application form.

Print it and start to fill with your pen.

First of all, you have to Choose Credit Card Type.

So choose Amazing Cash for Business (Cash Back) option and enter your existing Zions Savings or Checking Account Number.

Then choose one of the following options, if you want (online banking, annual statements, intelliLink reporting or Visa Card Management).

Step 4 – On this step, you have to provide your Business information.

Provide Legal Business Name, Business Street Address, Tax ID Number, Business Phone, City, State, Zip Code, Number of Employees. Then provide the mailing address (only if it is different from the business address).

Enter Gross Annual Sales, Last FYE Profit before Tax and Monthly Debt Payments.

Then select Business Debt Balances (unsecured and secured) and Total Checking and Savings Account Balances.

Then select the type of your organization and write down Business Name, as it should appear on the card.

Step 5 – Fill out the fields, marked in blue color, they are required. Enter Company Name and Authorizing Officer Names.

After that write down the Title and Date.

Step 6 – If you are a representative of a non-profit organization – skip this step.

Otherwise, provide names of your Personal Guarantors and all the requested information about them.

Step 7 – Read the agreement carefully and let your Guarantors Sign it.

Provide the Date as well (if you represent a non-profit organization – skip it).

Step 8 – To complete your application, you can request Cash Advances and add an authorized users to your account.

Fill the form and add users if you would like to.

FAQs

Q: What does making a deposit include and how much should it be?

To make a deposit means to put money on your account when you open it. This can be done by visiting bank branch and hand cash, by mail when you send paper checks or money to your bank or electronically by transferring money from one bank account to another. The amount of deposit depends on the bank account you are opening and the bank itself. The minimum amount, as well as the maximum is limited and it is advisable to ask about that information at the bank itself.

Q: What is a digital payment?

A digital payment is a completely electronic transaction between the buyer and seller. It means that no cash, checks or card inserting is necessary any more. Digital payments become more and more popular with both goods and services, because they are easily available and simple. Security is at the first place and the technology, called tokenization, behind digital payments has developed increasingly security in mind. Zions Bank offers their cardholders several digital payment options, so as to experience a simple, personal and convenient way to pay every day.

Q: What does a pre-tax annual income stand for?

The pre-tax annual income stands for the person’s total income which is calculated before the payment of any kind of tax. However, this amount is determined after he/she takes deductions. It represents the total amount of income that a person earned annually from all sources.

Permium Credit Card Offers

Compare Zions AmaZing Cash Back Business Credit Card

Recently Compared With (by users)

Wells Fargo Rewards Visa Card

Wells Fargo Rewards Visa Card

Plenti American Express Credit Card

Plenti American Express Credit Card

Continental Finance Matrix Credit Card

Continental Finance Matrix Credit Card

Frontier Airlines Credit Card

Frontier Airlines Credit Card

World Wildlife Fund BankAmericard Credit Card

World Wildlife Fund BankAmericard Credit Card

Amex Blue Cash Preferred Credit Card

Amex Blue Cash Preferred Credit Card

American Express Platinum Delta SkyMiles Business Credit Card

American Express Platinum Delta SkyMiles Business Credit Card

Fifth Third Real Life Rewards Credit Card

See All Comparisons >>

Fifth Third Real Life Rewards Credit Card

See All Comparisons >>