How to Apply to Zions AmaZing Rate Business Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewZions AmaZing Rate Business Card is a very attractive low-interest card. It offers low Purchase APR as well as competitive Cash Advance APR. Furthermore, there is no annual fee. You can use your card everywhere Visa is accepted and enjoy all the other benefits. All you have to do- is to apply for the card. So in this tutorial, we will show you how to fill your application form.

Requirements

In order to apply, you must:

- Provide Company’s Name and all the required information;

- Provide financial information;

- Provide Personal Guarantors – for all organizations, excepting non-profit organizations.

How to Apply

Before you decide to apply for Zions Amazing Rate Business Credit Card, we must inform you, that you can not do it online.

In order to apply you have to visit your local Zions Bank and apply in person.

Step 1 – Visit Zions Banks website and look on the right side of the screen.

Click ‘Get Started‘ in order to download an application form.

Step 2 – Now you can download your Application form.

Press ‘Download Application‘, then open it and print it.

After that, you can start filling it.

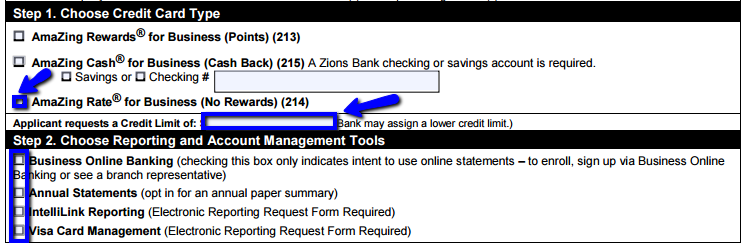

Step 3 – Take your pen and start filling your application form.

Firstly, choose a Credit Card you’re applying for.

So select ‘AmaZing Rate for Business‘.

After that, you need to request a credit limit, but remember, that Bank may assign a lower credit limit.

Step 4 – Next you are supposed to provide your Business Information.

You have to write down your Legal Business Name, Tax ID Number, Business Phone, Business and Mailing Address, and some financial information.

Then write down the company name as it will be written on the card.

Remember, you have to fill all the fields, marked in blue in order to get approved.

Step 5 – Now enter a Company Name Again and add Authorized Officer Names.

Then write down titles and the date.

Step 6 – If you owe a non-profit organization, you don’t have to fill this form.

All other applicants should provide Names and all the required information about Personal Guarantors.

Complete and sign the following section.

Step 7 – Let your Guarantors Sign this form (don’t forget to write a date).

Step 8 – Now you are able to request access to Cash Advances and to add Authorized Users.

You can add up to 10 authorized users, so go ahead and fill the form.

After your application form is completed, just visit the nearest Zions location and give it to the customer service representative.

FAQs

Q: What does Visa SavingsEdge include?

Visa SavingsEdge is a service which provides discounts on qualifying purchases at participating merchants to the owners of the Visa Business credit cards. You do not have to pay any fee, but to simply register your valid Visa Business credit card at www.visasavingsedge.com. Once enrolled, you will receive automatic discounts as statement credits when you use your Zions AmaZing Rate Business Credit card.

Q: Why is business card better than the personal one, if you have a developed business?

A business credit card is better than the personal one when you already have a business, because of many reasons. Some of them are related to recordkeeping, meaning that a business card’s online portal or application might help. Also, business credit cards can help you build business credit by using a business credit card and paying the bill on time. Nevertheless, your business credit can impact your business’s ability to qualify for loans and credit lines.

Q: What kind of business-specific benefits are offered by the business card?

Even though, personal credit cards offer a variety of benefits, the business credit cards often offer similar benefits, but they are designed to help the business owners. Those benefits can be free employee cards, meaning that your employees are given a card by which they can make purchases on the business’s behalf, but you are able to monitor their spending and control the usage of the card. You can also get cash back rewards on shipping, advertising and other common business purchases and have a higher purchase protection and cover more expensive purchases.

Permium Credit Card Offers

Compare Zions AmaZing Rate Business Credit Card

Recently Compared With (by users)

BrandsMart USA Credit Card

BrandsMart USA Credit Card

Arvest Visa Gold Credit Card

Arvest Visa Gold Credit Card

Chrysler MasterCard

Chrysler MasterCard

First Savings Credit Card

First Savings Credit Card

Express Next Credit Card

Express Next Credit Card

Barclaycard Ring Mastercard

Barclaycard Ring Mastercard

American Express Platinum Delta SkyMiles Business Credit Card

American Express Platinum Delta SkyMiles Business Credit Card

Affinity Credit Union Choice Rewards World Elite Mastercard

See All Comparisons >>

Affinity Credit Union Choice Rewards World Elite Mastercard

See All Comparisons >>