AgFed Credit Union Platinum Visa Credit Card Login | Make a Payment

Card Info

Card Info

Application

Application

Card Rating

Share Your Opinion

Review this card now and let others know your thoughts.

Click here to leave a reviewIf you are an AgFed Credit Union Platinum Visa Credit Card holder you can manage your credit online by accessing the AgFed online banking platform. Our guide below will provide detailed information on the login process, credential retrieval and first enrollment to online banking.

How to Login / Make a Payment

Here are the steps to follow in order to login to the AgFed online banking:

Step 1: Navigate to the AgFed Credit Union homepage and press the ‘Login’ button.

Step 2: Introduce in the provided boxes your Member number or Username followed by your Password and press ‘Login to account.’

Forgot Password / Username

In case you lost your username and/or password, simply follow these steps in order to retrieve/reset them:

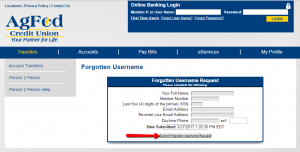

Step 1 (Username): Open the login window and click on the ‘Forgot your username’ link.

Step 2 (Username): In the new window which will open introduce all the required information including your full name, member number, last four digits of your SSN, email address and your daytime phone. Click on the ‘Submit Forgotten Username Request’ button to forward your request to the bank.

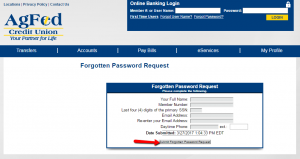

Step 1 (Password): Open the login pop-up window and click on the ‘Forgot your password’ link.

Step 2 (Password): Fill in the boxes provided with the required information including your: full name, member number, last four digits of your SSN, email address and your daytime phone. Press ‘Submit Forgotten Password Request’ button to forward your request and get assistance with the password reset.

Activation / Registration

All new AgFed Credit Union Platinum Visa Credit Card users will need to activate their online account in order to be able to access their credit online. You will need to do the activation only the first time you access the online banking. These are the steps:

Step 1: Navigate to the AgFed Credit Union homepage and click on the ‘Login’ button. In the login window, locate the ‘First Time Users’ link and click on it.

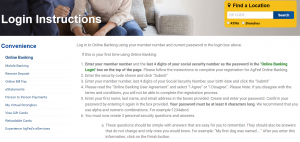

Step 2: Next, you’ll find instructions on how to log in for the first time to your online account. Make sure to read and follow carefully these instructions:

- Introduce your member number and the last 4 digits of your social security number as the password in the “Online Banking Login” box on the top of the page. Then insert the security code shown and click “Submit”.

- Introduce again your member number, the last 4 digits of your Social Security Number, your birth date and press the “Submit” button.

- Carefully read the “Online Banking User Agreement” and select “I Agree.”

- Provide your first name, last name, and email address in the appropriate spaces. Enter a chosen password too. Confirm your password by introducing it again in the box provided.

- Create three personal security questions and answers and press the ‘Finish’ button to complete your first access to online banking.

FAQs

Q: What kind of questions should security questions be?

The security questions are used to protect your account and they are usually created by the account owners themselves. There are situations when they are already given, and the account holder just needs to provide the unique answer. In order to make a good security question you need to be aware that it should be simple, that it cannot be easily guessed or researched, that it does not change and can be simply remembered and that it has many possible different answers.

Q: What is a Loan payment protection?

Loan payment protection or also known as Payment protection insurance is an insurance product that enables clients to ensure repayment of credit if the borrower dies, becomes disabled, and loses a job which thus prevents him/her from earning income to pay the debt. It is sold by banks and other credit providers as an add-on to the loan. All kinds of loans, such as car loans, loans and home mortgage borrowing can be insured. Credit card issuers offer a standard loan payment protection, but there are some specific categories, too.

Q: How safe is Agriculture Federal Credit Union?

The Agriculture Federal Credit Union is NCUA insured union which maintains the highest standards in both lending and savings. It constantly receives the best rating for safety by the National Credit Union Administration. All members' deposits are insured up to $250,000 by the NCUA, while there are different types of account ownership that may increase that amount.

Permium Credit Card Offers

Compare AgFed Credit Union Platinum Visa Credit Card

Recently Compared With (by users)

Fifth Third Platinum MasterCard

Fifth Third Platinum MasterCard

Exxon-Mobil Business Credit Card

Exxon-Mobil Business Credit Card

Total Visa Unsecured Credit Card

Total Visa Unsecured Credit Card

Gander Mountain Credit Card

Gander Mountain Credit Card

Alliant Visa Platinum Rewards Credit Card

Alliant Visa Platinum Rewards Credit Card

Peebles Credit Card

Peebles Credit Card

Capital One® Spark® Classic for Business Credit Card

Capital One® Spark® Classic for Business Credit Card

Dick’s Sporting Goods Credit Card

See All Comparisons >>

Dick’s Sporting Goods Credit Card

See All Comparisons >>