How to Apply to Arvest Classic Visa Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewThe Arvest Classic Visa Credit Card issued by the Arvest Bank provides great credit lines to customers at a local level (Oklahoma, Kansas, Missouri and Arkansas). This card has no annual fee, a low APR for the first six months and offers other MasterCard benefits. Make sure to read our guide before your application.

Requirements

If you are interested in applying for this credit card, you need to fulfill the following criteria of eligibility:

- Be 18 of age or older

- Be a resident of one of the following states: Oklahoma, Kansas, Missouri and Arkansas

- Be open to provide information regarding your finances and employment situation

How to Apply

In this guide we have included all the necessary information you need in order to successfully complete and submit an online application. These are the required steps you need to follow:

Step 1: Visit the card’s homepage and, after taking a careful look at the specific features included in this offer, press the ‘Apply Now’ button.

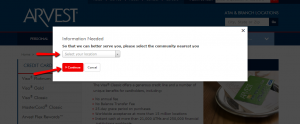

Step 2: In the pop-up window, select your location among the available options and click on the ‘Continue’ button.

Step 3: In the application window which will open provide all the required information regarding the primary applicant. This information must include the applicant’s: first name, last name, name displayed on card, social security number, date of birth, security password, primary phone number, residential street address, city, state, Zip code, time at the current address, housing situation, driver’s license number or state issued ID number and issuing date.

Step 4: Introduce also the information regarding the primary applicant’s financial situation including: current employer name, time with employer, the current Arvest relationship, monthly gross income and source of income. Press the ‘Submit’ button to complete your application.

FAQs

Q: What systems does Visa apply to ensure that the online banking system is secure and safe?

Each and every credit card issuer does its best to make Online Banking secure, since that is the present and the future of banking. Banks as well as other issuers use the highest level of encryption available today, meaning that your information is first translated into undecryptable code and then back to recognized information. Visa credit cards use the greatest possible security systems and all the data provided once you apply for the credit card is secure and safe. The safety is of the highest concern of all the banks.

Q: How can I differentiate between revolving or non-revolving account?

While revolving account allows the owner to use the credit repeatedly as long as he/she fulfills his/her payments on time, non-revolving account owners have the credit that cannot be used again after it is paid off. Before deciding which account to open you should take into consideration the fact that prior to borrowing the money, you make an agreement to an interest rate and a fixed repayment schedule that you need to pay each month according to that agreement. Usually, non-revolving credit has a lower interest rate, but it does not have the flexibility of revolving credit and that should be thought about.

Permium Credit Card Offers

Compare Arvest Classic Visa Credit Card

Recently Compared With (by users)

BrandsMart USA Credit Card

BrandsMart USA Credit Card

Arvest Platinum Credit Card

Arvest Platinum Credit Card

Southwest Rapid Rewards Premier Credit Card

Southwest Rapid Rewards Premier Credit Card

AAA Member Rewards Credit Card

AAA Member Rewards Credit Card

BP Visa Credit Card

BP Visa Credit Card

Royal Caribbean Visa Credit Card

Royal Caribbean Visa Credit Card

USAA Rewards Visa Signature Card

USAA Rewards Visa Signature Card

ASU Rewards Credit Card

See All Comparisons >>

ASU Rewards Credit Card

See All Comparisons >>