How to Apply to ASU Rewards Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

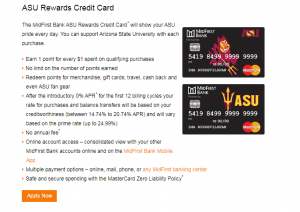

Click here to leave a reviewHolders of the ASU Rewards Credit Card can earn rewards points while supporting the Arizona State University just by using their credit card. Current students, faculty members and staff of the Arizona State University may consider applying for it and enjoy the benefits this card has to offer.

Requirements

At the time of your online application for this card, make sure you meet the following eligibility criteria:

- Be 18 of age or older

- Have a valid social security number, a photo ID document and a home address

- Be open to provide information regarding your current and past employment, your monthly income, housing payments and other financial information including debts and assets

How to Apply

Step 1: Open the MidFirst Bank cards’ homepage and press the ‘Apply Now’ button under the description of this ASU Platinum Credit Card.

Step 2: Read the E-Sign and Credit Card Application Disclosures which you can find in the next page and check the appropriate box to indicate your consent. Select ‘yes’ or ‘no’ to indicate your customer status at MidFirst Bank.

Step 3: Scroll down in the same page and enter your personal information including: name (First, MI, Last), date of birth, social security number, contact method, phone number, email address, residential Zip code. Select the credit card type (Platinum), purpose of loan, type of collateral offered and promo code (optional). Click on the ‘Continue’ button to proceed.

Step 4: Introduce the primary applicant information, by adding to the previously inserted information the following: photo ID document, ID issue date, ID issue state, ID number, ID expiration date, mother’s maiden name. Select your marital status and insert your physical address information (street, number, city, state), followed by the time at the current address Select your property status, mortgage/rent payment, mailing address and contact phone.

Step 5: Complete the boxes provided with your employment information including: employment status, other source of income, gross income, description and payment frequency. Press ‘Continue.’

Step 6: You can add any additional information you may consider helpful for the current application in the additional comments box. Select also ‘yes’ or ‘no’ to the question: ‘Will you use Automatic Payments?’ and then press the ‘Continue’ button.

Step 7: Review the information provided in the next page. Press ‘Edit’ in case you find any mistakes or ‘Submit Application’ to forward your online application to the bank for further review.

FAQs

Q: How can I obtain social security number?

In case you want to apply for social security number, you must give your foreign birth certificate if you have it or some other documents, like your passport, as evidence of your age. In order to get the number, you will have to apply for a Social Security Card. A Social Security number is necessary if you want to work and to collect Social Security benefits, so only non-citizens authorized to work in the US are eligible for a Social Security number.

Q: Is it necessary to put the purpose of loan when applying for ASU Rewards Credit Card?

Yes, one of the obligatory field when filling in the application form for ASU Rewards Credit Card is the purpose of loan, so it needs to be filled in, so as for the application to be accepted. Otherwise, the system will decline it as incomplete.

Q: Where can I find the ID issue date?

Issue date represents the date your ID was issued and it is usually written at the front of your ID card. It issue data is sometimes necessary when filling in the application form for the credit cards. ASU Rewards Credit Card application demands that the client enters the issue date of his/her ID.

Permium Credit Card Offers

Compare ASU Rewards Credit Card

Recently Compared With (by users)

Wells Fargo Cash Wise Visa Card

Wells Fargo Cash Wise Visa Card

ABC Warehouse Credit Card

ABC Warehouse Credit Card

Citi Prestige Credit Card

Citi Prestige Credit Card

Dressbarn Credit Card

Dressbarn Credit Card

Affinity Credit Union Low Fee MasterCard

Affinity Credit Union Low Fee MasterCard

Royal Caribbean Visa Credit Card

Royal Caribbean Visa Credit Card

Walmart Credit Card

Walmart Credit Card

BB&T Spectrum Rewards Credit Card

See All Comparisons >>

BB&T Spectrum Rewards Credit Card

See All Comparisons >>