How to Apply to The Avenue Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewThe Avenue Credit Card is a good deal for those, who buy from The Avenue on a regular basis. Are you a fan of plus-size fashion? Do you want to enjoy all the benefits provided by the Credit Card? If you do, you should stay with us. We will share with you all the information you need to know in order to get approved.

Requirements

If you would like to apply for the Avenue Credit Card, you MUST meet those requirements:

- Have to be 18 years old or more;

- Have a valid ID;

- Have a Social Security Number;

- Have to be a United States resident;

- Have mailing address;

How to Apply

In order to get approved for the Avenue Credit Card, you have to provide accurate and valid information.

We will help you to do it right.

Step 1 – First of all, you have to visit Comenity’s Bank page.

When you are on a right web-site, read the information about the benefits and rewards, and then press ‘Apply’.

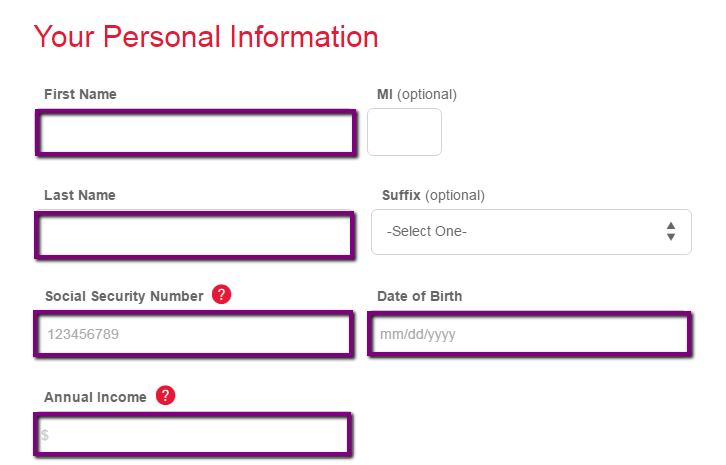

Step 2 – Enter your personal information.

You are supposed to provide your First and Last Name, your Social Security Number, your Date of Birth and Annual Income.

Make sure all the provided information is correct and go to the next step.

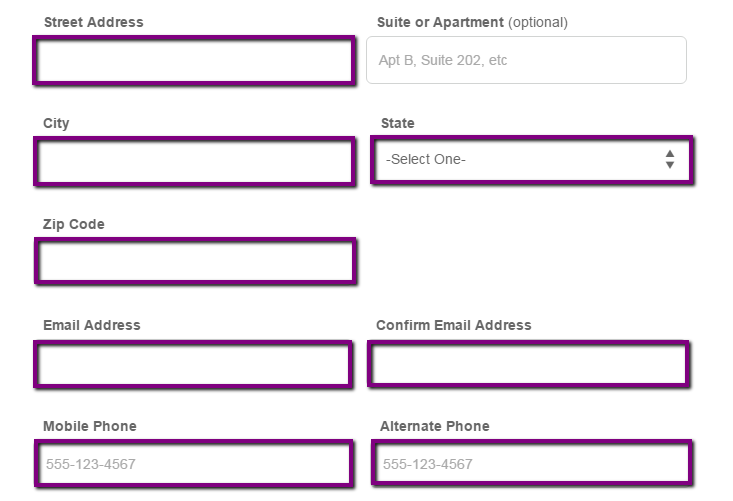

Step 3 – On this step you have to provide your contact and mailing information.

Remember, all fields, marked in purple colour are required to fill.

So please, enter your Street Address, City and State, Zip Code, E-Mail Address and Mobile Phone.

Then you have to confirm your phone number and E-mail.

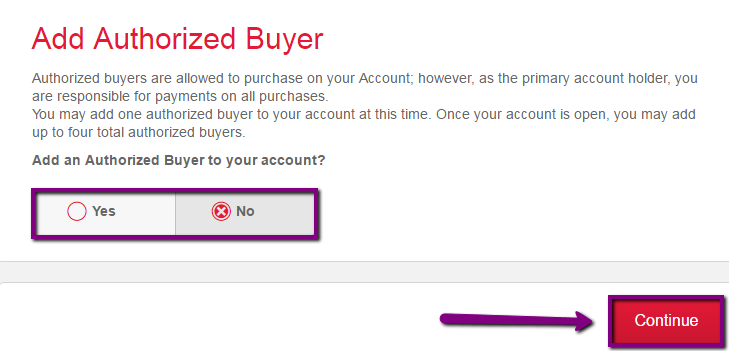

Step 4 – On the last step of your application you will be proposed to add an Authorized buyer to your Account.

Authorized Buyers are allowed to purchase on your account, but you will be responsible for all the payments.

So, if you want to add a buyer- press ‘Yes‘.

If you don’t want- press ‘No‘ and ‘Continue’.

FAQs

Q: What kinds of benefits does the Platinum Cardmember get?

A person becomes a Platinum Cardmember when he/she spends $200 on the Gold Card within a 12 month period. Once achieved, this status makes numerous benefits available to you, besides getting all the regular benefits that each cardmember gets. He/she also receives a $20 Certificate with the Platinum Card, special offers monthly, exclusive access to the Platinum Customer Service Hotline and for every 200 points gets a $10 In-Store Rewards Certificate.

Q: Am I charged any kind of fee when making my payment online?

The most of credit cards allow its holders to open online banking account so as to be able to use it for online shopping and whatever and whenever you make your payment online, you can be sure that there is no fee charged to your account for making online payments. It is a completely free service and that is why the online banking exists at all.

Q: I am asked for an alternate identification. What should I enter?

Alternate Identification is the proof of identification for those people who do not possess a Social Security Number. It can be Driver's License, Federal, State or Municipal identification card with photo, Military ID with photo, Passport with photo or Current Student identification card with photo, or a Green Card. You were asked for the alternate identification, since its aim is to determine your personality due to safety reasons. If you are a person who is given Individual Taxpayer Identification Number, it can also be used as identification on credit card applications.

Permium Credit Card Offers

Compare The Avenue Credit Card

Recently Compared With (by users)

Princess Cruises Rewards Visa Credit Card

Princess Cruises Rewards Visa Credit Card

First Savings Credit Card

First Savings Credit Card

Shell Platinum Credit Card

Shell Platinum Credit Card

Pier One Credit Card

Pier One Credit Card

Bergdorf Goodman Credit Card

Bergdorf Goodman Credit Card

Disney Premier Visa Card

Disney Premier Visa Card

Chase Freedom Credit Card

Chase Freedom Credit Card

Diamond Resorts Credit Card

See All Comparisons >>

Diamond Resorts Credit Card

See All Comparisons >>