How to Apply to BankAmericard Secured Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewWith its assistance in building and strengthening your credit history, as well as its zero fraud liability and online/overdraft security, the BankAmericard Credit Card can be a good option for many customers. Should you decide to get such a card, we will show you how to complete an online application.

Requirements

Before starting to fill in the online application form for a BankAmericard Credit Card, check the list of eligibility criteria below to see whether you are an appropriate candidate:

- You should be at least 18 years old

- You must be a U.S. resident with a valid social security number and a valid mailing address

- You should also have a valid email address and phone number

- You should be open to provide information during the application process regarding your housing and employment status (including monthly mortgage or rent, annual income)

How to Apply

Here are the steps you need to follow to fill in and submit your application for getting a BankAmericard Credit Card.

Step 1: Go to the card’s homepage and press ‘Apply Now’ in order to open the secured online application form.

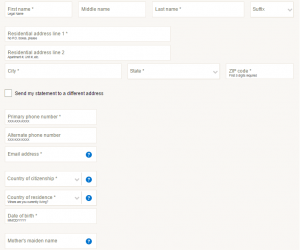

Step 2: Enter in the appropriate fields your personal information, including: first name, middle name (optional), last name, suffix (optional), residential address (you can also choose whether you would like your bank statements to be sent to this or other address), primary phone number, alternate phone number (optional), email address, country of citizenship, country of residence, date of birth and mother’s maiden name (optional).

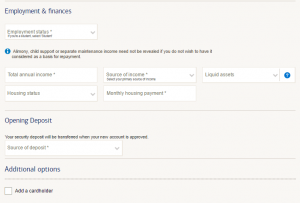

Step 3: Provide details about your employment and your financial situation, including employment status, total annual income, source of income, liquid assets (optional), housing status, monthly housing payment and the source of your security deposit. Additionally, you can add another cardholder.

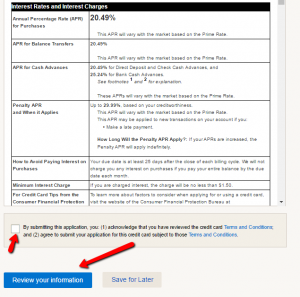

Step 4: Review the card’s Terms and Conditions, check the appropriate box to show that you agree with all of them and press “Review your information” to make sure all the data you introduced is correct and to submit your online application.

FAQs

Q: What are the interest rates for the owners of BankAmericard Secured Credit Card?

The interest rates for the BankAmericard Secured Credit Card holders differ. The Annual Percentage Rate for Purchases is 21.49% and it can vary based on the Prime Rate. The Annual Percentage Rate for Balance Transfers is also 21.49%.The APR for Cash Advances differs, meaning that it is 21.49% for Direct Deposit and Check Cash Advances, and 26.24% for Bank Cash Advances. There is no penalty APR. Of course, no interest on purchases is charged if the card holder pays the entire balance by the due date each month.

Q: What are the fees when using BankAmericard Secured Credit Card?

The Annual Fee for BankAmericard Secured Credit Card is $39, while transaction fees differ. The fee for the purchase from a non-financial institution is either $10 or 5% of the amount of each transaction. Balance Transfer fee can be either $10 or 3% of the amount of each transaction while a direct deposit and check cash advances fee can be $10 or 3% of the amount of each transaction. Some other fees are ATM, Over-the-Counter, Same-Day Online and Cash Equivalent Cash Advances $10 or 5% of the amount of each transaction and Foreign Transaction fee which is 3% of the U.S. dollar amount of each transaction.

Permium Credit Card Offers

Compare BankAmericard Secured Credit Card

Recently Compared With (by users)

Affinity Credit Union No Fee Choice Rewards MasterCard

Affinity Credit Union No Fee Choice Rewards MasterCard

World Wildlife Fund BankAmericard Credit Card

World Wildlife Fund BankAmericard Credit Card

Royal Caribbean Visa Credit Card

Royal Caribbean Visa Credit Card

J Crew Credit Card

J Crew Credit Card

AgFed Credit Union Secured Visa Credit Card

AgFed Credit Union Secured Visa Credit Card

Miles and More Premier World Mastercard

Miles and More Premier World Mastercard

Wells Fargo Cash Back College Visa Card

Wells Fargo Cash Back College Visa Card

Arvest Classic Mastercard Credit Card

See All Comparisons >>

Arvest Classic Mastercard Credit Card

See All Comparisons >>