How to Apply to Briggs and Stratton Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

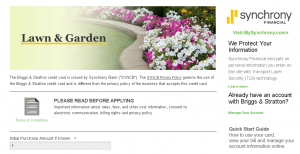

Click here to leave a reviewSeeking to get low-interest financing for a new Briggs and Stratton engine? Now you can do it by simply applying for a Briggs and Stratton Credit Card, finally made possible by the partnership between Briggs and Stratton and Synchrony Bank. Most importantly, you can apply for this card online. Below, we’ll guide you through the application process.

Requirements

You need to meet the following criteria before applying for your Briggs and Stratton Credit Card:

- Be 18-year-old or more

- Be a permanent resident of the U.S.

- Have in your possession a valid Social Security Number, an email address, and a phone number.

How to Apply

Step 1: Visit the Briggs and Stratton Credit Card’s electronic application web page. Make sure to read the terms and conditions of the Synchrony Bank, as well as those related to the Briggs and Stratton Credit Card. If possible, complete the first box related to the initial purchase amount (if known).

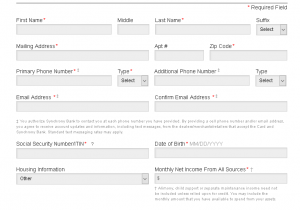

Step 2: Provide all the necessary personal information including your: first name, middle name (optional), last name, suffix (optional), valid mailing address, city, state, Zip code, primary phone number, email address, Social Security Number, date of birth, housing information (rent/own) and monthly net income from all sources.

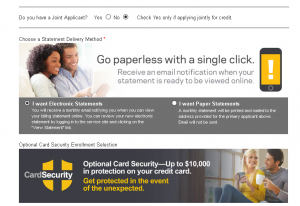

Step 3: Select whether you want to have a Joint Applicant or not.

Check ‘Yes’ only if applying jointly for credit. You can also choose a statement delivery method by selecting the electronic or paper method.

Step 4: Read and consider carefully whether you might want to take advantage from the optional Card Security Enrollment Selection.

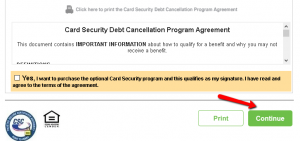

Scroll down the page and tick the relevant box if you want to purchase the optional Card Security program (note that if you check ‘Yes’ that qualifies as your signature).

Click the ‘Continue’ button.

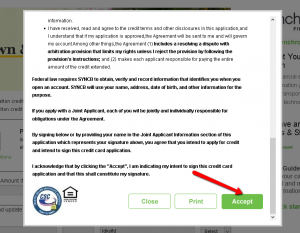

Step 5: Read for the final time the terms and conditions related to your credit card application.Scroll down until the bottom of the small window and agree with the terms and conditions by clicking the ‘Accept’ button. You’ll learn about the result of your application immediately after submitting.

Scroll down until the bottom of the small window and agree with the terms and conditions by clicking the ‘Accept’ button. You’ll learn about the result of your application immediately after submitting.

FAQs

Q: What are the benefits of the optional Card Security Enrollment Selection?

The optional Card Security program allows the clients to cancel their account balance up to $10,000 if some unpredictable and sudden issues occur, such as unemployment, hospitalization, disability or death. The Card Security Enrollment Selection costs $1.66 per $100 of the ending monthly balance, but it provides a piece of mind for the events that catches you unprepared.

Q: What should I do if I want to close my account with Synchrony Bank?

Customer Service via the number which is written on the back of your card. Another number you can call is 866-396-8254. You can close your account whenever you want to by contacting Synchrony Bank

Q: What is a chat option?

A chat option is offered to Synchrony Bank cardholders who do not want to call customer service by phone but communicate online via chat with a live agent who is the member of the Customer Service team. Chat is available form 9 a.m. ET to 7:30 p.m. ET form Monday to Friday and the icon on your screen shows whether a Chat Agent is available or not. In order to communicate, you need to be logged into the Chat application.

Permium Credit Card Offers

Compare Briggs and Stratton Credit Card

Recently Compared With (by users)

Tires Plus Credit Card

Tires Plus Credit Card

American Express® Green Card

American Express® Green Card

State Farm Rewards Visa Credit Card

State Farm Rewards Visa Credit Card

Banana Republic Credit Card

Banana Republic Credit Card

Discover it Chrome Student Credit Card

Discover it Chrome Student Credit Card

Chase Ink Plus Business Credit Card

Chase Ink Plus Business Credit Card

Affinity Credit Union Low Fee MasterCard

Affinity Credit Union Low Fee MasterCard

American Express Plum Card Credit Card

See All Comparisons >>

American Express Plum Card Credit Card

See All Comparisons >>