How to Apply to Central Bank ONLY Card MasterCard

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewWith its great point rewards system and no introductory APR for 6 months, the Central Bank ONLY MasterCard can be everything you ever wanted from a credit card. Should you decide to get one, you can find information on this page regarding the online application process.

Requirements

In case you decide to apply for a Central Bank ONLY MasterCard, make sure you meet all the conditions of eligibility listed below:

- Be at least 18 years of age

- Be a resident of the US and have a valid US postal address

- Have a valid social security number

- Have a valid email address and phone number

- Be willing to provide information regarding your employment and financial status

How to Apply

If you decided to apply for a Central Bank ONLY MasterCard, here are the steps you have to follow to complete an online application:

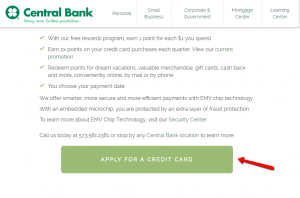

Step 1: On the credit card’s homepage click on ‘APPLY FOR A CREDIT CARD.’

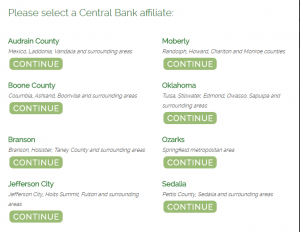

Step 2: Select a Central Bank affiliate and press ‘CONTINUE.’

Step 3: Click on ‘Apply Now’ under the ‘Credit Card’ option.

Step 4: If you have an offer code and you have been referred by an employee, introduce your offer or referral code, then check the ‘I’m not a robot’ box and press ‘Continue to Application.’

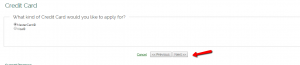

Step 5: Select ‘MasterCard’ as the kind of credit card you want to apply for and click ‘Next.’

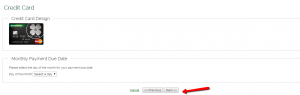

Step 6: Select your monthly payment due date and press ‘Next.’

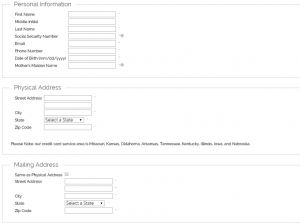

Step 7: Enter your first name, middle initial (optional), last name, social security number, email address, phone number, date of birth, mother’s maiden name, street address, city, state, Zip code, and mailing address (if different from the physical address).

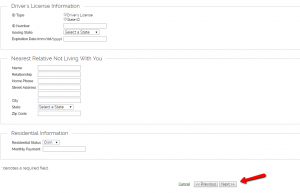

Step 8: Introduce your driver’s license information (ID type, ID number, issuing state, expiration date), details regarding the nearest relative not living with you (name, relationship, home phone, street address, city, state, Zip code) and your residential information (residential status and monthly payment) and click ‘Next.’

Step 9: In the following pages you will need to introduce your employment information, co-applicant information (in case you have one) and, after reviewing your application, you will be able to finally submit it.

FAQs

Q: What is a secure session?

When trying to access your account online, browsers usually give you a message box which shows you the moment you get into a secure session so as to be sure that you are protected and that your personal details are secure. Different browsers use diverse messages. For Internet Explorer it is a small locked padlock icon on the bottom right side of the window. Netscape Navigator uses a key unbroken icon in the lower left corner of the screen to show secure session Another indication is the address which will begin with (http:) for non-secure mode and with (https:) in secure mode.

Q: My transactions appeared on my statement and the Transactions Web page. Why?

Statements are created on a determined date each month and during the year that date can fall on a weekend or on a holiday when the processing is not performed. So, additional transactions can appear on both the Transactions web page and on your statement. This does not mean that you were charged twice, and that can be easily checked. If the reference number on the transaction on the web page and on your statement is the same, then your credit card account has been charged for one transaction. If it happens not to be the same, you will need to contact the credit card issuer.

Permium Credit Card Offers

Compare Central Bank ONLY Card MasterCard

Recently Compared With (by users)

Hilton Honors American Express Card

Hilton Honors American Express Card

Target Red Card Credit Card

Target Red Card Credit Card

American Express® Gold Card

American Express® Gold Card

QVC Qcard Credit Card

QVC Qcard Credit Card

Torrid Credit Card

Torrid Credit Card

American Signature Furniture Credit Card

American Signature Furniture Credit Card

Capital One® Spark® Classic for Business Credit Card

Capital One® Spark® Classic for Business Credit Card

American Express Business Gold Rewards Credit Card

See All Comparisons >>

American Express Business Gold Rewards Credit Card

See All Comparisons >>