How to Apply to Chrysler MasterCard

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

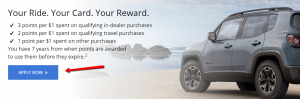

Click here to leave a reviewWith its fantastic point rewards system, 0% introductory APR for the first 6 billing cycles, zero fraud liability, and travel accident insurance, the Chrysler MasterCard is a perfect choice, particularly for frequent travelers. Should you decide to get this card, we’re here to guide you through the online application process.

Requirements

Prior to filling in the application, check the following conditions of eligibility:

- You should be at least 18 years of age

- You must have a valid social security number, postal address, email address and phone number

- You should be open to disclosing information regarding your financial status, including your total annual income and your monthly housing payments

How to Apply

If you would like to submit an application for acquiring a Chrysler MasterCard, here are the steps you need to follow in order to fill in an online application:

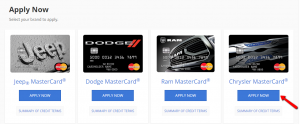

Step 1: Navigate to the card’s homepage and click on the ‘APPLY NOW’ button. You’ll be directed to a page where you can select the card of your choice.

Step 2: Press ‘APPLY NOW’ under the Chrysler MasterCard to open the online application form.

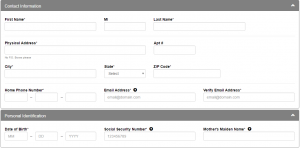

Step 3: Introduce in the appropriate spaces details regarding your contact information, including your first name, middle initial (optional), last name, physical address, apartment (optional), city, state, Zip Code, home phone number and email address

Furthermore, provide also your date of birth, social security number, and mother’s maiden name in the ‘Personal Identification’ section.

Step 4: Provide your housing and financial information, including your housing status (own/rent/other), your monthly housing payment, your present employer, your business phone number (optional) and your total annual income.

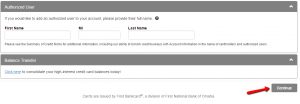

Step 5: If you would like, you can add another authorized user by providing his/her first name, middle initial and last name.

Finally, choose whether you would like to transfer your balances from other accounts to your new account and click ‘Continue’ to send your application for review.

Soon after, you’ll be contacted and informed whether you will get this card.

FAQs

Q: How can I contact First Bankcard if I have issues with my account?

You can contact them via e-mail or call them on certain phone numbers, depending on the issue you have trouble with. The Credit Card Customer Service number is 1-888-295-5540. In case you want to report lost or stolen credit card, you should call 1-800-444-6938. Number for technical Assistance is 1-888-467-2217 and for requesting Cardmember Agreement is 1-888-295-5540. Another way of contacting them is via the mail sent to Bankcard Payment Processing PO Box 2557 Omaha, NE 68103-2557 or First Bankcard C/O First National Bank of Omaha P.O. Box 2340 Omaha, NE 68103.

Q: What is the signature panel code?

The Signature Panel Code appears on the back of your card, on the signature panel and consists of three digits after your account number. It is used to ensure that you really possess the card you are registering. It represents the unique characteristic of your account and some merchants might require it in order to make purchases online. That is another way of protection against fraud and unauthorized usage of cards.

Q: What privileges are given to an authorized user?

You, as a primary cardholder, are the one that determines the authorized users. The privileges of the authorized user are that he/she can make purchases on your account but he/she is not responsible for the possible debt. Also, an authorized user neither can be enrolled online to online banking platform, nor make changes to the account.

Permium Credit Card Offers

Compare Chrysler MasterCard

Recently Compared With (by users)

ABOC Platinum Rewards MasterCard Credit Card

ABOC Platinum Rewards MasterCard Credit Card

Buckle Credit Card

Buckle Credit Card

Bank of Hawaii Visa Credit Card

Bank of Hawaii Visa Credit Card

Zions AmaZing Rewards Business Credit Card

Zions AmaZing Rewards Business Credit Card

Westpac Altitude Platinum Credit Card

Westpac Altitude Platinum Credit Card

Wyndham Rewards Visa Credit Card

Wyndham Rewards Visa Credit Card

Associated Bank Visa Bonus Plus Rewards Credit Card

Associated Bank Visa Bonus Plus Rewards Credit Card

Hawaiian Airlines Credit Card

See All Comparisons >>

Hawaiian Airlines Credit Card

See All Comparisons >>