How to Apply to Continental Finance Surge Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewThe Continental Finance Surge Credit Card provides you the unique opportunity to improve your credit score and creditworthiness and to consequently create a better credit history. At this moment there is no online application procedure for getting this card, but you can contact instead Continental Finance for guidance on how to acquire their credit card.

Requirements

Before contacting Continental Finance to apply for this credit card, it is highly important to make sure that you meet all of the following conditions of eligibility / requirements:

- Be at least 18 years of age or older

- Be a permanent legal resident of the United States of America

- Have a valid Social Security Number

- Be willing to provide to Continental Finance information regarding your income and your credit history

How to Apply

At this moment, unfortunately, there is no possibility for applying online to get a Continental Finance Surge Credit Card. Nevertheless, it is very simple to find the necessary contact information in order to discuss with Continental Finance’s staff personally details regarding the application process.

Here are the steps you should follow in order to secure this information:

Step 1: Visit the credit card’s main web page, scroll down to the bottom of the page and click on the ‘Contact Us’ button.

Step 2: After pressing the ‘Contact Us’ button a web page will open on which you will find a list of all the credit cards issued by Continental Finance. At this step, you must of course click on the Surge card’s logo to open the contact information page.

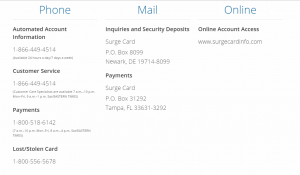

Step 3: On the contact information page you will find a list with various phone numbers, postal addresses and a webpage associated with the Surge credit card. The best thing to do is dial the number 1-866-449-4514 (Customer Service) and ask the staff information regarding what steps you have to take in order to apply for a Continental Finance Surge Credit Card.

FAQs

Q: What is a Continental Credit Protection?

Continental Credit Protection is a program offered by Continental Finance to its clients which allows them to protect their credit cards. The purchase of Continental Credit Protection is optional and will not affect your application for credit. The cost of this program is $0.99 for each $100 of the Outstanding Account Balance and if your Outstanding Account Balance is $200, the Program fee for that month will be $1.98. Once you apply for the Continental Credit Protection, you will receive a contract that fully describes the Program’s benefits as well as the conditions, exclusions, and restrictions. You can cancel the Program at any time. If you are not satisfied with the program and cancel it within the first thirty days, the charged fees will be refunded. If you have any questions about Continental Credit Protection program you can call 866-665-7967 on Monday through Friday from 8 am to 6 pm.

Q: There are some personal information whose sharing can be limited, and some whose sharing cannot be limited? Why cannot all sharing be limited?

There are rules that are applied to credit card application process and they determine which information sharing can be and which cannot be limited. Federal law allows the limitation sharing of certain information, e.g. about your creditworthiness while state laws and individual companies may give you additional rights to limit sharing.

Permium Credit Card Offers

Compare Continental Finance Surge Credit Card

Recently Compared With (by users)

BB&T Spectrum Rewards Credit Card

BB&T Spectrum Rewards Credit Card

Barclaycard Ring Mastercard

Barclaycard Ring Mastercard

Farm Sanctuary Credit Card

Farm Sanctuary Credit Card

British Airways Visa Signature® Card

British Airways Visa Signature® Card

Belk Credit Card

Belk Credit Card

Westpac Low Rate Credit Card

Westpac Low Rate Credit Card

Affinity Credit Union Low Fee Gold Choice Rewards MasterCard

Affinity Credit Union Low Fee Gold Choice Rewards MasterCard

Walmart Credit Card

See All Comparisons >>

Walmart Credit Card

See All Comparisons >>