How to Apply to First Savings Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewFirst Savings credit card is the card option for people who currently have a bad credit rating . Whether you want to build credit or want to have your first card, this is the card for you. Read the how-to below to get started on your credit card application.

Requirements

If you want to apply to a First Savings credit card, the most basic requirements that you need to have to be eligible are as follows:

- Be 18 years old or above

- Must be a U.S. Citizen living in the United States

- Must have a U.S. Social Security number

The full eligibility requirements are found on the eligibility form. To receive this form by mail, you have to call the First Savings Credit Card customer service line at 1-888-469-0291.

How to Apply

Step 1: Call the First Savings customer service line at 1-888-469-0291 to request an application form which they will mail to you.

The application for the credit card cannot be done all online.

Talking to a representative will help you clear out any questions (if you have any) that you might have about the card.

Step 2: As soon as you receive the form, access the First Savings credit card website through this link. Once in the homepage, click on the accept online button on the upper right side of the page.

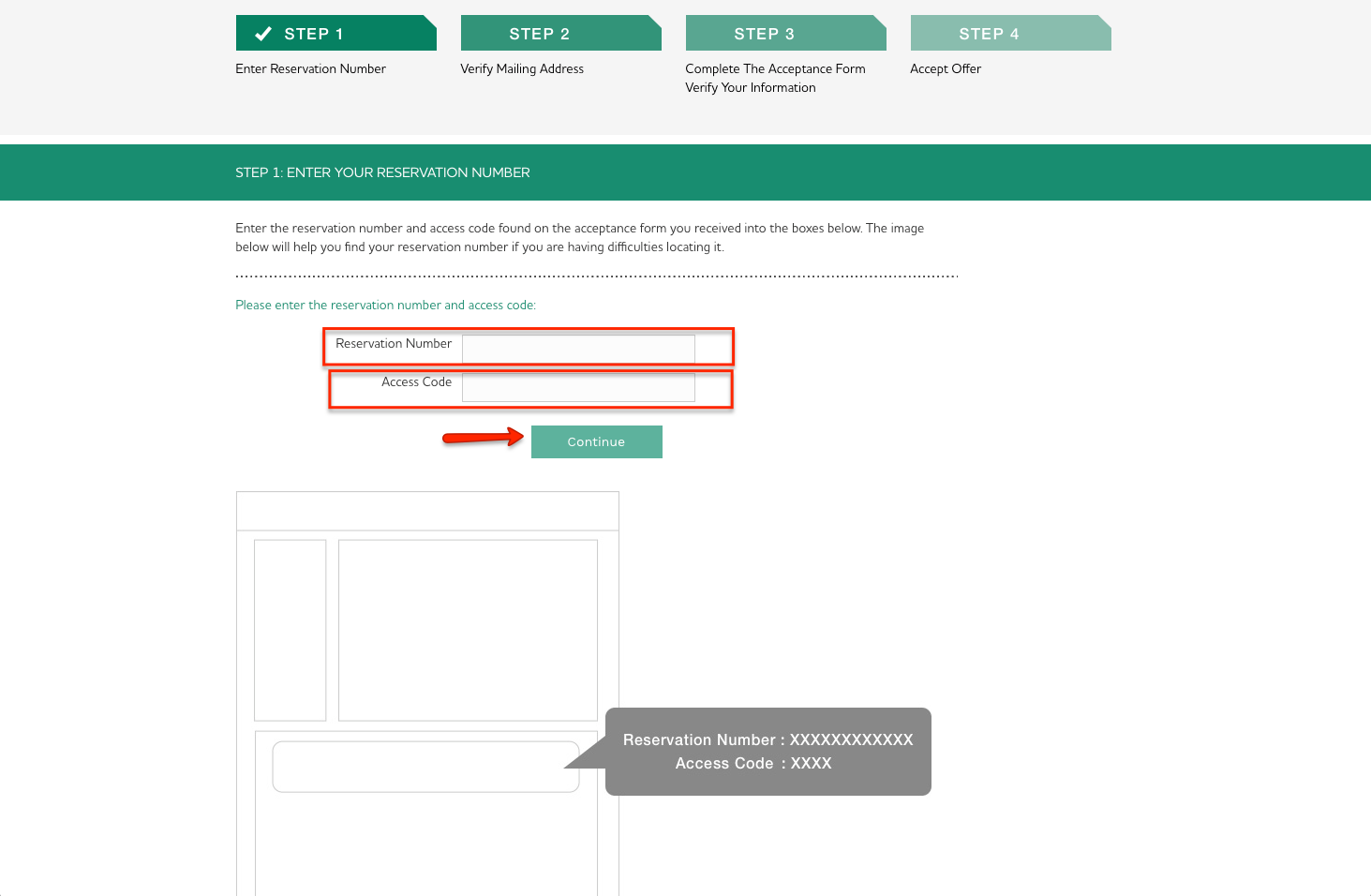

Step 3: On this page, you will be asked to provide your reservation number and access code. The reservation number and access code can be found on the application form that you have received.

If you have trouble locating your reservation number and access code on the form, simply refer to the image provided on this page.

Input the needed information on the required fields and click on continue. Follow the succeeding prompts to register online

Step 4: The application process is a four step process.

Continue filling up the form until you reach the step 4 where you confirm the acceptance of the offer that was sent to you.

FAQs

Q: What does SecureCode stand for?

MasterCard SecureCode is a service available of your First Savings Credit Card that provides greater protection when you shop online fighting against the unauthorized use of your card. Once you have registered and created a SecureCode, whenever you shop online, you will be asked to provide it, similar to using a PIN at the ATM. The correctly SecureCode confirms the card issuer confirms that you are the authorized cardholder and your purchase is allowed. In case the wrong code is entered, there is no purchase.

Q: How can I know whether the terminal is designed to insert my card or swipe it?

There are two types of terminals, where you either need to swipe or insert your card. However, you do not need to worry about whether it is correct to swipe it or insert it. If you swipe your chip card at a terminal that is designed for inserting, the terminal will stop the transaction and instruct you to insert the card in the chip reader instead. On those terminals that do not have a slot to insert the card, you just swipe it to complete the transaction.

Q: How does a bank calculate APR rate?

The calculation of the APR is a very simple process. The calculation goes when you divide the finance charge by the loan amount, then multiply the result by 365. The result that you get should be divided by the term of the loan and then multiplied by 100.

Permium Credit Card Offers

Compare First Savings Credit Card

Recently Compared With (by users)

Affinity Credit Union Low Fee MasterCard

Affinity Credit Union Low Fee MasterCard

Express Next Credit Card

Express Next Credit Card

TJ Maxx Credit Card

TJ Maxx Credit Card

Ashley Stewart Credit Card

Ashley Stewart Credit Card

Williams-Sonoma Credit Card

Williams-Sonoma Credit Card

Citi ThankYou Credit Card

Citi ThankYou Credit Card

British Airways Visa Signature® Card

British Airways Visa Signature® Card

Chevron VISA Card

See All Comparisons >>

Chevron VISA Card

See All Comparisons >>