How to Apply to Susan G. Komen BankAmericard Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewThe Susan G. Komen BankAmericard Credit Card, known also as the Pink Ribbon BankAmericard is created for those how want to help the fight against breast cancer. This card is an amazing cash rewards opportunity to always have with you and it will cost you nothing ($0 annual fee.)

Requirements

- Be a US resident

- Be 18 years of age or older

- Have a valid social security number or a tax identification number

How to Apply

Step 1: From the card’s main page click on the ‘Apply Now’ button.

Step 2: Provide all the required personal information including your: full name, valid mailing address, and valid phone number.

Step 3: Enter your financial information under the Employment & Finances section, including your annual income, source of income and your monthly housing payment. In case you would like to transfer your balance to your new card select the ‘Transfer a balance to my new credit card’ under the Additional options section.

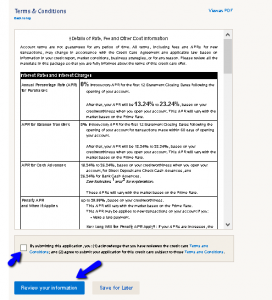

Step 4: Read carefully the Terms & Conditions and check the box under this section to submit your application (in doing so you agree to the conditions introduced in the Terms & Conditions section for this credit card). Finally, click on the ‘Review your Information’ button and you will be able to submit your application for your new MasterCard.

FAQs

Q: What is Susan G. Komen organization?

Nancy G. Brinker promised her dying sister, Susan in 1980 that she would fight against breast cancer forever and turned that promise into the Susan G. Komen organization which has grown into the world’s largest nonprofit source of funding for the fight against breast cancer in the United States. It invests into breast cancer education, research, advocacy, health services and has more than 100,000 volunteers working worldwide.

Q: Are there disadvantages of Susan G. Komen BankAmericard Credit Card?

Yes, as with any other credit card, there are disadvantages such as charges for a Foreign Transaction Fee which is 3%, the card has a Penalty APR which can be a big problem for people who occasionally miss their statement due dates, there is no Credit Score or Credit-Building Tools and it requires you to accumulate at least $25 in cash back before you can redeem.

Q: Can the Automatic Payment option be changed?

Just as it can be set up, automatic payment option can also be changed. This option allows you that bills which are constant each month are paid automatically on a scheduled and predetermined date. The client can start or stop automatic payment any time he/she wants to online by logging into the website, entering account credentials and determining whether to turn on the automatic payment or not.

Permium Credit Card Offers

Compare Susan G. Komen BankAmericard Credit Card

Recently Compared With (by users)

American Express® Gold Card

American Express® Gold Card

American Kennel Club Visa Credit Card

American Kennel Club Visa Credit Card

PC Richard & Son Credit Card

PC Richard & Son Credit Card

Amex Everyday Credit Card

Amex Everyday Credit Card

Citi Secured Mastercard

Citi Secured Mastercard

Capital One® Secured Mastercard® Credit Card

Capital One® Secured Mastercard® Credit Card

St. Louis Blues Mastercard

St. Louis Blues Mastercard

Best Western Rewards MasterCard

See All Comparisons >>

Best Western Rewards MasterCard

See All Comparisons >>