How to Apply to Total Visa Unsecured Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewIf you are reading this article, you might be thinking about applying for the Total Visa Unsecured Credit Card. What does this card offer you? It offers to increase your credit score. But let’s talk about disadvantages too. You will have to pay high purchase APR and 29.99% Cash advance APR as well as late payment fee up to $37. Still want to apply? Then scroll down to see a tutorial.

Requirements

- Must be at least 18 years old;

- Must be US Citizen;

- Must have SSN;

- Poor Credit Score is accepted.

How to Apply

Before you apply, we have to tell you some important things.

First of all, you have to know about the registration fee.

When you are approved for Total Visa Unsecured Credit Card, you have to activate your card online and pay $89 for the activation. Otherwise, your card will not work.

Step 1 – First of all, visit Total Visa Unsecured Credit Card online web page.

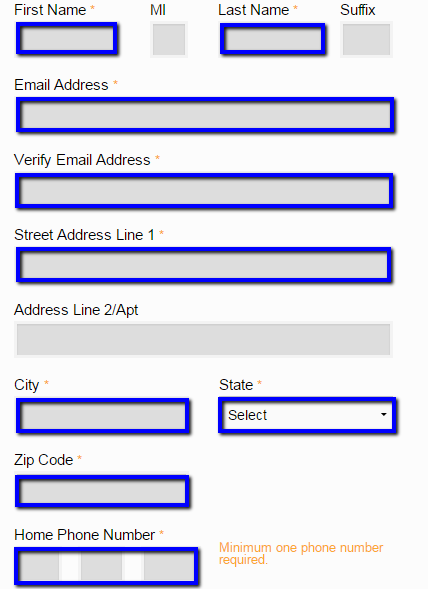

On this page, you will see an application form, which you are supposed to complete. Fill out all the fields, marked in blue color.

Enter your First and Last Name, your E-mail Address (don’t forget to verify it), then enter your Street Address, City, State, Zip Code and your Home Phone Number. Make sure that all the required fields are filled and go to the next step.

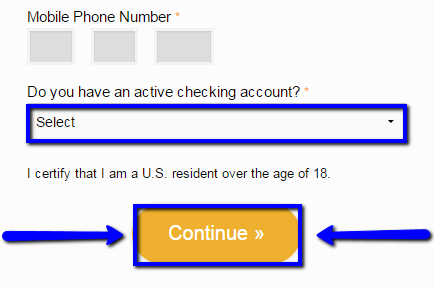

Step 2 – To complete your application enter your Mobile Phone Number.

Remember, you have to enter at least one valid number. Then answer the question ‘Do you have an active checking account’.

Choose the answer from the list, which is right for you. After that press ‘Continue’.

When you press it, you certify that you are a United States citizen over the age of 18.

You will receive a result of your application in few minutes after you pressed ‘Continue‘.

FAQs

Q: What kinds of fees does the Total Visa Unsecured Credit Card include?

There are numerous fees, such as Annual fee of $75.00 when your Account is opened and $48.00 every twelve months thereafter whether or not you use your Account, Monthly Servicing Fee which will not be charged for the first year but later will be $6.25 per month. Late Payment Fee is applied if the bank does not receive payment from you in at least the amount of your Total Minimum Payment Due by the due date shown on your monthly billing statement which can be either $27.00 or $38.00. If any item is returned unpaid for any reason, you will be charged a Returned Payment Fee. Additional Card Fee is paid if you authorize us to issue an additional Card for your Account and it is $29.00. Express Delivery Fee is $35.00 for the express delivery of your Card and Copying Fee is $3.00 per page if you request duplicates of any monthly billing statement or other document.

Q: What are the most attractive features of Total Visa Credit card?

Some of the reasons why people decide to get the Total Visa Credit card are he features such as that it does not require a security deposit, the rate for cash advances is the same as for purchases and transactions are reported to all major credit bureaus so this is a good way to start re-building your credit.

Permium Credit Card Offers

Compare Total Visa Unsecured Credit Card

Recently Compared With (by users)

Wells Fargo Rewards Visa Card

Wells Fargo Rewards Visa Card

NHL Discover it Credit Card

NHL Discover it Credit Card

American Express® Green Card

American Express® Green Card

Associated Bank Visa Bonus Rewards Credit Card

Associated Bank Visa Bonus Rewards Credit Card

Pottery Barn Credit Card

Pottery Barn Credit Card

Capital One® Secured Mastercard® Credit Card

Capital One® Secured Mastercard® Credit Card

JetBlue Credit Card

JetBlue Credit Card

Club Carlson Business Rewards Visa

See All Comparisons >>

Club Carlson Business Rewards Visa

See All Comparisons >>