Total Visa Unsecured Credit Card Login | Make a Payment

Card Info

Card Info

Application

Application

Card Rating

Share Your Opinion

Review this card now and let others know your thoughts.

Click here to leave a reviewIf you are already approved for Total Visa Unsecured Credit Card, you should register for online access. How can you do that? Easy. First of all, you have to pay $89 registration fee in order to set up your online account. We will show you how to register your card online and how to use your online account in order to manage your payments.

How to Login / Make a Payment

Step 1 – Visit the issuer’s website.

When you are on the right page, look on the right side of the screen and you will see a sign in form.

Step 2 – Now choose if you have personal or business account. Then enter your user ID and press ‘Login’.

Step 3 – After that you will have to enter your Password. So do it and press ‘Submit’.

Forgot Password / Username

Step 1 – Go back to the website and enter your User ID. If you have forgotten your ID, simply skip it and press ‘Login’.

Step 2 – On the next page, you will be asked to enter your password.

Click on ‘Forgot Password?’ button.

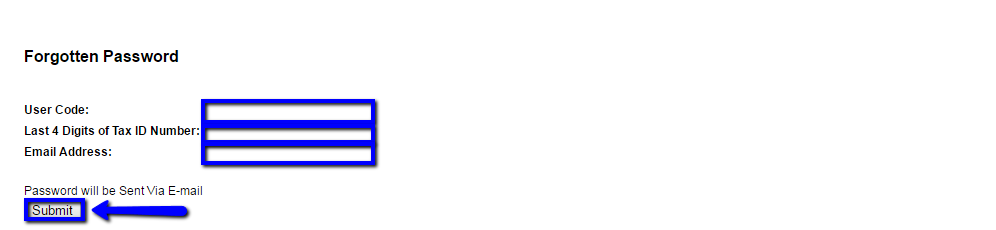

Step 3 – In order to retrieve your password enter your User Code, last 4 Digits of Tax ID Number and your E-mail address.

After that press ‘Submit’. Your password will be sent via E-Mail immediately.

Activation / Registration

Step 1 – If you want to activate your card and register for online access, choose ‘Enroll Today‘ button and press it.

Step 2 – Fill out all the fields, marked in blue color.

Please, enter your Social Security Number, your First and Last Name, your E-Mail Address, Account Number and Type.

Then choose your security question and enter an answer.Then enter the last four digits of your SSN or Telephone Banking Password.

After that press ‘Submit‘.

FAQs

Q: What is an unsecured credit card?

Unsecured credit cards are credit cards which do not require a security deposit to be approved for the credit card or to get credit limit increases. Unsecured credit cards are not directly connected to property that a lender can seize if the cardholder fails to pay and you have the ability to borrow money from the credit card company. However, this kind of card is not recommended if your top priority is rebuilding your credit.

Q: Who should apply for the Total Visa Unsecured Credit card?

The Total Visa Unsecured Credit card accepts applications from people even with not so perfect credit but who want a fast application process and reporting to all three credit bureaus. This is not a good card for people who are frequent travelers since it cannot be used abroad or with foreign merchants online.

Q: How can I get a credit limit increase?

In order to get the credit limit increase, you need to request it but only after your account has been open for at least six month. The issuer will not increase your credit limit by themsleves, but you are the one who has to call and ask Mid America Bank & Trust Company at 1-800-720-7178.

Permium Credit Card Offers

Compare Total Visa Unsecured Credit Card

Recently Compared With (by users)

PC Richard & Son Credit Card

PC Richard & Son Credit Card

Wells Fargo Cash Back College Visa Card

Wells Fargo Cash Back College Visa Card

Mercedes-Benz Amex Credit Card

Mercedes-Benz Amex Credit Card

Bank of Hawaii Visa Credit Card

Bank of Hawaii Visa Credit Card

Best Buy Credit Card

Best Buy Credit Card

Fifth Third Business Rewards Credit Card

Fifth Third Business Rewards Credit Card

Westpac Altitude Platinum Credit Card

Westpac Altitude Platinum Credit Card

Gap Credit Card

See All Comparisons >>

Gap Credit Card

See All Comparisons >>

It is very well thought out and interesting informative content. Thank you for sharing!