How to Apply to Zions AmaZing Rewards Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewThe great advantage of the Zions AmaZing Rewards Credit Card is its rewards program which enables you to earn points on everyday purchases and apply them to tickets or airline services. If you are considering on getting this card, here we’ll provide you a detailed guide on how to fill in and submit an online application.

Requirements

Before applying for a Zions AmaZing Rewards Credit Card make sure to meet the following criteria of eligibility/requirements:

- Be 18 years of age or older

- Be a U.S. resident (eligible applicants must either reside in Utah, Idaho, or Wyoming or have an existing banking relationship with Zions Bank in order to be considered for credit)

- Have a valid mailing/postal address, email address, and phone number

- Possess a valid social security number

- Be open to providing details about your financial situation, including your monthly mortgage/rent as well as your annual income.

How to Apply

Follow our guide below to get help with all the steps you must follow in order to complete and submit an online application for a Zions AmaZing Rewards Credit Card:

Step 1: To open the online application form you must visit the credit card’s main web page and click on the ‘Apply Now’ button.

Step 2: Choose whether you would like to apply as an individual or whether you would like to fill in a joint application.

Select also the state in which you live. Note that the Zions Bank’s eligible applicants must either reside in Utah, Idaho, or Wyoming or have an existing banking relationship with Zions Bank in order to be considered for credit.

If you want to start your banking relationship you might apply for a checking or savings account online.

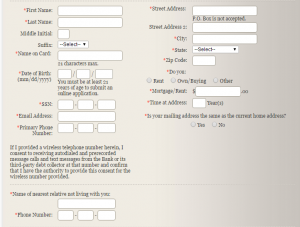

Step 3: Introduce details about yourself including the following: first name, last name, middle initial and suffix (optional), name on card, date of birth, social security number, email address, primary phone number, the name and phone number of the nearest relative not living with you, your street address, city, state, Zip Code.

Select whether you own or rent your house, enter the monthly mortgage rate or rent and provide details regarding how long have you lived there.

Finally, choose whether your home address and mailing address are the same.

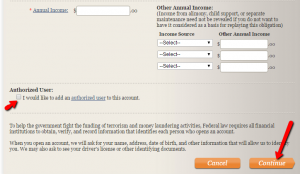

Step 4: Enter the details regarding your annual income and choose whether you would like to add another authorized user.

In order to submit your application for evaluation, click on the ‘Continue’ button.

Soon, you will receive information about the outcome of your application.

FAQs

Q: Why am I asked to provide my mother’s maiden name and how can it be helpful when it comes to the security of my credit card account?

Some of credit card issuers ask for mother’s maiden name, in order to make sure that you are the person who owns the account. That information is something that it not known to many people and it is not easy to discover it. That is why some personal information is frequently asked by the credit card company when you fill out an application for a credit card. That information provided needs to have one and only correct answer, to be easily remembered and that everybody has it, so mother's maiden name is the best solution which fulfills all the previously mentioned conditions.

Q: What is Satisfaction Guarantee?

The owners of some credit cards have the Satisfaction Guarantee service available which allows them to get the refund for the product paid using the card in case they are not satisfied with their purchase and the store does not want to accept the return. The refund is only acceptable within 60 days of purchase and only in case the merchant did not want to return money and was asked for it.

Permium Credit Card Offers

Compare Zions AmaZing Rewards Credit Card

Recently Compared With (by users)

Bergner’s Credit Card

Bergner’s Credit Card

Williams-Sonoma Credit Card

Williams-Sonoma Credit Card

BankAmericard Better Balance Rewards Credit Card

BankAmericard Better Balance Rewards Credit Card

Citi Diamond Preferred Credit Card

Citi Diamond Preferred Credit Card

Affinity Credit Union Choice Rewards World Elite Mastercard

Affinity Credit Union Choice Rewards World Elite Mastercard

American Express® Gold Card

American Express® Gold Card

Norwegian Cruise Line MasterCard Credit Card

Norwegian Cruise Line MasterCard Credit Card

First Progress Platinum Select Mastercard Secured Credit Card

See All Comparisons >>

First Progress Platinum Select Mastercard Secured Credit Card

See All Comparisons >>