How to Apply to AT&T Access More Citi Credit Card

Card Info

Card Info

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewThe AT&T Access More Citi Credit Card issued by Citi Bank is a very rewarding credit card offering amazing point benefits. If you decide to apply for this card, we are here to provide a step-by-step guide on how to fill in and submit an online application.

Requirements

Make sure you meet all the requirements listed below before starting an online application:

- Be at least 18 years of age

- Be a US citizen with a valid social security number and a valid mailing address

- Have a valid email address and phone number

- Be open to provide details regarding your employment and financial situation during the application process

How to Apply

Below are the steps you should follow in order to complete and submit an online application form:

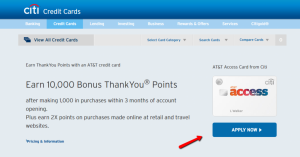

Step 1: Access the credit card’s homepage and click on the ‘APPLY NOW’ button to open the online application form.

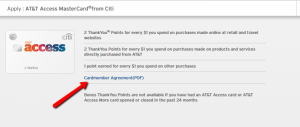

Step 2: Download and read carefully the Cardmember Agreement by pressing the PDF link as shown below.

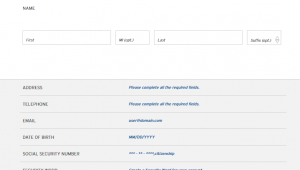

Step 3: In the online application form which will open provide your full name (optionally also your middle initial and suffix), address (home address, apartment/suite (optional), Zip Code, city, state), telephone, email address, date of birth, social security number and create a security word for your account.

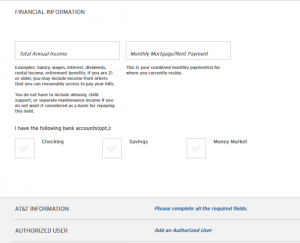

Step 4: Enter also your financial information including: the total annual income and monthly mortgage/rent payment and choose whether you are or not already an AT&T customer. If you want you can optionally add an authorized user at no additional costs by clicking on the link shown below.

Step 5: Read the Electronic Disclosures associated with this card and, should you agree with all of them, check the provided box.

Step 6: As a last step you need to review the Terms and Conditions associated with this card and agree to them by checking the appropriate box. Press the ‘SUBMIT’ button to forward you application to the bank for evaluation.

FAQs

Q: What does EMV Chip Technology stand for?

The increasing number of card fraud has lead the U.S. card issuers to get together and try to find a solution in the new technology, so as to protect their clients and reduce the amount of fraud. EMV stands for Europay, MasterCard and Visa which are cards that use computer chips to protect and secure card transactions. Nowadays, it is becoming the global standard of protection, since the technology functions that way that every time an EMV card is used for payment, the card chip creates a unique transaction code that cannot be used again. From the beginning of the usage of this kind of card, the fraud rates have decreased in the U.S.

Q: Who is a Citi Personal Wealth Management Financial Advisor?

Citi Personal Wealth Management Financial Advisor is a person who can help you connect your financial picture with the future aspirations. All you need to do is to present your future plans, such as retirement, child's education, or any other financial demands, and the Citi Personal Wealth Management Financial Advisor will help you develop a financial plan according to what meet your needs and at the same time is the best option for you. Actually, an experienced Citi Personal Wealth Management Financial Advisor will work with on the identification of your financial goals until you make them a reality.

Permium Credit Card Offers

Compare AT&T Access More Citi Credit Card

Recently Compared With (by users)

Capital One® Quicksilver® Cash Rewards Credit Card

Capital One® Quicksilver® Cash Rewards Credit Card

Gordmans Credit Card

Gordmans Credit Card

Victoria’s Secret Angel Credit Card

Victoria’s Secret Angel Credit Card

ABC Warehouse Credit Card

ABC Warehouse Credit Card

Wells Fargo Platinum Visa Card

Wells Fargo Platinum Visa Card

ABNB Visa Platinum Rewards Credit Card

ABNB Visa Platinum Rewards Credit Card

Dick’s Sporting Goods Credit Card

Dick’s Sporting Goods Credit Card

Zions AmaZing Cash Back Business Credit Card

See All Comparisons >>

Zions AmaZing Cash Back Business Credit Card

See All Comparisons >>