How to Apply to Bealls Florida Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewIf you want to benefit from the Bealls Florida Credit Card’s generous points reward system, birthday bonus, and finally earn a Gold Customer status, do not hesitate to apply to get this great card. On this page, we provide a step by step guide on how to complete your application.

Requirements

In order to be eligible to apply for the Bealls Florida Credit Card, you must meet the following requirements:

- Be at least 18 years old

- Be a legal U.S. resident currently living in the United States

- Have a valid photo ID issued by the government

- Have a U.S. Social Security Number

- Have a valid postal/mailing address as well as a valid phone number and email address

How to Apply

The application process for the Bealls Florida Credit Card is relatively straightforward and will not take more than 10 minutes.

Here are the steps you must follow and details about the information you should provide in order to apply:

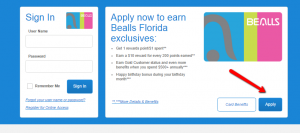

Step 1: Go to Bealls Florida Credit Card’s main webpage and click on the ‘Apply’ button in order to open the online application form.

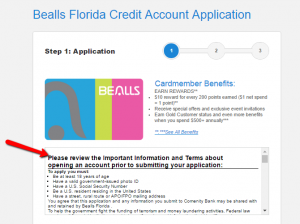

Step 2: Read carefully and review the Important Information and Terms regarding opening a Bealls Florida account before starting your online application.

Step 3: Introduce information about your personal details such as your first and last name, social security number, date of birth and annual income.

Step 4: Introduce details regarding your contact information, including your postal/mailing address (street, suite/apartment, city, state, Zip code), your email address and your phone number.

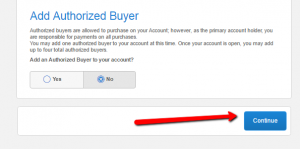

Step 5: Finally, choose whether you would like to add an Authorized Buyer(s) who would be able to do purchases from your account and click on the ‘Continue’ button.

After providing this information, you will be asked to review all the data you entered in order to make sure that everything is correct and submit your application.

FAQs

Q: What is the difference between a store card and a regular credit card?

The main difference between these two cards is the fact that if you want a credit card which can be used everywhere then you should search for a regular credit card which will meet your needs and demands. On the other hand, a store card is only accepted at certain stores and you cannot withdraw money from ATMs nor pay with it in other stores and services.

Q: Do I need to possess an excellent credit score to apply for this card?

No, you do not have to possess it. The aim of all store cards is to attract as many customers as possible and they issue the card even to those people who have only a fair credit score.

Q: What is an alternate identification?

Alternate Identification refers to Alternate proof of identification in case you do not possess a Social Security Number. The proofs of identification can be Driver's License, Federal, State or Municipal identification card with photo, Military ID with photo, Passport with photo or Current Student identification card with photo, or a Green Card. Their aim is determining your personality due to safety reasons. Also, people who cannot get the Social Security Number are given Individual Taxpayer Identification Number, or ITIN, also a nine-digit number which can be used as identification on credit card applications.

Permium Credit Card Offers

Compare Bealls Florida Credit Card

Recently Compared With (by users)

Affinity Credit Union No Fee Choice Rewards MasterCard

Affinity Credit Union No Fee Choice Rewards MasterCard

Amex Blue Sky Credit Card

Amex Blue Sky Credit Card

KickBack Card

KickBack Card

Macy’s Credit Card

Macy’s Credit Card

Chevron VISA Card

Chevron VISA Card

Costco Anywhere Visa® Credit Card

Costco Anywhere Visa® Credit Card

DSW Credit Card

DSW Credit Card

BBVA Compass Select Credit Card

See All Comparisons >>

BBVA Compass Select Credit Card

See All Comparisons >>