Capital One Secured Credit Card Login | Make a Payment

Card Info

Card Info

Application

Application

Card Rating

Share Your Opinion

Review this card now and let others know your thoughts.

Click here to leave a reviewCapital One Secured Credit Card has not only great benefits, including various types of insurance but also a user-friendly online platform where you can manage your account and make payments. We will now show you how to log in, what to do if you forgot your credentials and how to activate the account.

How to Login / Make a Payment

If you already have an online account, here is how you can log in:

Step 1: Open the credit card’s main web page and, on the upper side of the page, click on the ‘Sign In’ button.This will open a window where you can select the type of card your account is associated with.

This will open a window where you can select the type of card your account is associated with.

Step 2: In this new window, chose the ‘US Credit Cards’ option.

This will open the Sign In web page where you can introduce your username and password.

Step 3: Provide your username and password and press the ‘Login’ button.

Forgot Password / Username

In you already have an online account but you forgot your username and/or password, here is what you must do to retrieve them:

Step 1: Open the Login web page and click either on ‘Forgot User name’ or ‘Forgot password’ and you will be redirected to pages where you can retrieve your credentials.

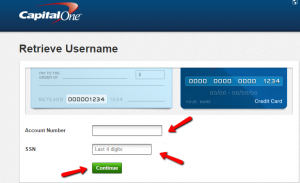

Step 2 (user name): In case you forgot your user name you will have to provide your account number and the last 4 digits of your social security number and click on ‘Continue.’

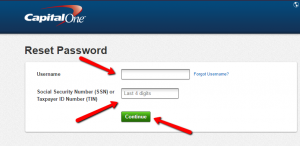

Step 2 (password): In case you forgot your password you will have to provide your user name and the last 4 digits of your social security number and click on ‘Continue.’

Activation / Registration

If you got a Capital One Secured Credit Card but you do not yet have an online account associated with it, here is how you can create one:

Step 1: Go to the Login web page and click on the ‘Sign Up Now’ button to navigate to a page where you will be asked to introduce information about yourself and your card in order to create an account.

Step 2: Introduce your 16 digits card number and security code, your date of birth and your social security number or taxpayer ID number and press ‘Continue.’

FAQs

Q: What is a correctional institution?

A correctional institution stands for a place where people who are in the lawful custody of the government are detained, so it is for people convicted of major crimes. In case you are currently in any kind of correctional institution, you are not eligible to apply for Capital One Secured credit card.

Q: What is the Initial Credit Line?

Each and every new credit card comes with an initial credit line. It is usually referred to as a credit limit. A credit line always reflects the maximum balance you can carry and the amount of it depends on a credit card company. In case of Capital One Secured credit card, you should make the minimum required security deposit and your initial credit line will be $200. When you deposit more money, then your account opens to get a higher credit line.

Q: What does the word “secured” on my credit indicate?

The secured credit card offers you a chance to build or rebuild your credit, but only with the refundable security deposit, which is held as collateral for the account if you do not act responsibly. There is no interest to the security deposit and a minimum required security deposit is necessary for the start. Once your minimum required security deposit is paid, your account is opened. The security deposit is refundable.

Permium Credit Card Offers

Compare Capital One® Secured Mastercard® Credit Card

Recently Compared With (by users)

J Crew Credit Card

J Crew Credit Card

Loft Credit Card

Loft Credit Card

Sears Credit Card

Sears Credit Card

American Express® Gold Card

American Express® Gold Card

Military Star Credit Card

Military Star Credit Card

Elvis Presley Credit Card

Elvis Presley Credit Card

Citibank Simplicity Credit Card

Citibank Simplicity Credit Card

Milestone Gold MasterCard Credit Card

See All Comparisons >>

Milestone Gold MasterCard Credit Card

See All Comparisons >>