How to Apply to Fifth Third Real Life Rewards Credit Card

Card Info

Card Info

Secure Login

Secure Login

Card Rating

Want to make a difference?

Rate this card now and let others know your thoughts.

Click here to leave a reviewWith its fantastic point rewards system and 0% introductory APR in the first 12 billing cycles, the Fifth Third Real Life Rewards Credit Card is something you should definitely consider. If you decide to apply for this card, find below information on how to fill in and submit an online application form.

Requirements

Before filling in the online application form for a Fifth Third Real Life Rewards Credit Card, make sure you meet the conditions of eligibility listed below:

- Be at least 18 years of age

- Be a U.S. citizen or a resident of U.S. with a valid mailing address and a valid social security number

- Have a valid phone number and email address

- Be open to disclose personal information, such as your address, social security number, phone number etc.

How to Apply

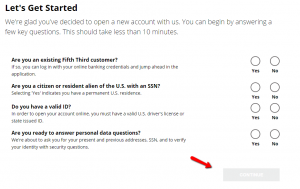

Step 1: Open the online application page and answer with either ‘yes’ or ‘no’ questions regarding whether you are an existing Fifth Third customer, a citizen or resident alien of the U.S. with a social security number, whether you have a valid ID and whether you are ready to answer personal data questions. Afterwards click on the ‘CONTINUE’ button.

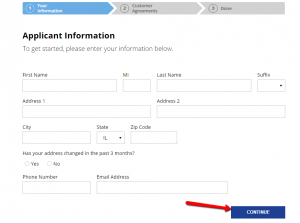

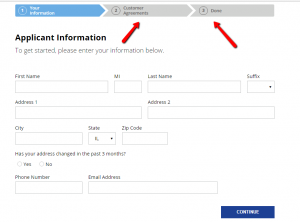

Step 2: Introduce information about yourself including: your first name, middle initial, last name, suffix, address(es), city, state, Zip code (as well as whether your address changed in the past 3 months or not), phone number and email address and press the ‘CONTINUE’ button.

Step 3: Read and review carefully all the Customer Agreements forms and, in case you agree with all the information provided in these forms, you will be able to finally submit your online application and wait for a decision from the Fifth Third Bank.

FAQs

Q: What can APR be useful for?

APR stands for the annual percentage rate and that is the price you pay for borrowing money from the bank during the period of one year. It actually represents the yearly cost of funds over the term of a loan including fees or additional costs associated with the transaction. APR can be useful to people when deciding which credit card to apply for, since each and every card issuer offers different APRs. It shows how expensive a transaction will be on each card.

Q: When I am trying to register for online banking, I am asked to enter my address and the zip code. Regarding the fact that I have more than one address, I do not know which one to use?

When it comes to addresses, you might be asked to provide both of them. On some platforms, one of the addresses is obligatory to be entered and the other one is optional. The zip code that needs to be provided is the one of your primary mailing address, which was given when you applied for the account. If you are not sure which are the correct contact information, you should contact the card issuer and ask for all information.

Permium Credit Card Offers

Compare Fifth Third Real Life Rewards Credit Card

Recently Compared With (by users)

American Express Business Green Rewards Credit Card

American Express Business Green Rewards Credit Card

Drury Gold Key Club Credit Card

Drury Gold Key Club Credit Card

ABC Warehouse Credit Card

ABC Warehouse Credit Card

Associated Bank Visa Bonus Plus Rewards Credit Card

Associated Bank Visa Bonus Plus Rewards Credit Card

AgFed Credit Union Classic Visa Credit Card

AgFed Credit Union Classic Visa Credit Card

ABNB Visa Platinum Rewards Credit Card

ABNB Visa Platinum Rewards Credit Card

U.S. Pride BankAmericard Credit Card

U.S. Pride BankAmericard Credit Card

Chrysler MasterCard

See All Comparisons >>

Chrysler MasterCard

See All Comparisons >>